Weak growth in SAM tools market – are SAM Managed Services to blame?

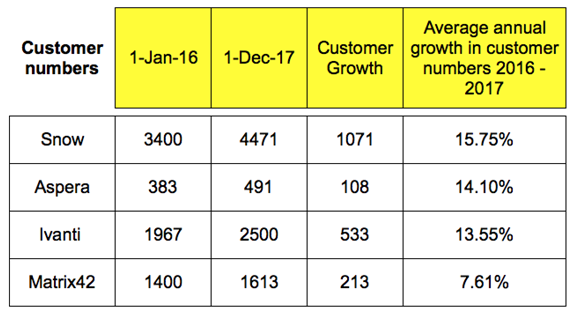

I recently polled some of the leading SAM tool vendors for their customer numbers.

I was keen to understand how much the market had grown since we last asked them in the SAM Tools Universe report back in 2016.

The SAM tools market is growing, but not as much as you would think.

Total customers on maintenance for Snow Software, Aspera, Ivanti and Matrix42 only grew by an average of 12.75% in the last two years.

Snow Software revenue is said to be growing at much faster rate than their customer numbers suggest. Which means they are either acquiring customers, but not keeping hold of them, or making more revenue per customer. Snow claim they are selling more to existing customers with significantly larger deal size.

Could the increase in SAM managed services be to blame for this relatively weak growth in customer numbers? We commonly see dissatisfaction with SAM tools, customers cite they are labour intensive despite being “automated”, and many SAM tools are yet to provide a holistic solution to management of cloud.

In contrast, talk with most SAM Managed Services providers and they claim to “work with any data source” to deliver an outcome, typically not caring whether the customer has a SAM tool or not.

What is your view? Is 12.75% growth across the top four SAM tool manufacturers what you expected? What do you think is to blame for relatively weak growth? Or is 12.75% a healthy growth rate for these top four suppliers? Please share your opinions in the comments.

Additional notes:

- Axios, making a bit more noise in the ITAM market, claim they have 73 ‘ITOM’ customers

- Brainware, Certero, Cherwell or Flexera did not respond.

- HPE (1,260 customers in 2016) declined to comment. We’ve heard SAM is no longer a focus area, I imagine it’s difficult to take HPE SAM seriously now they are owned by one of the world’s most aggressive auditors, Microfocus, whose shares recently halved in value following weak sales.

- ServiceNow stated they weren’t prepared to share customer numbers for specific product lines

- 1E, who seem to have retracted from the SAM market, have 77 customers, up from 75 in 2016.

Related articles:

- Tags: SAM technology · SAM Tools · SAM tools market

About Martin Thompson

Martin is also the founder of ITAM Forum, a not-for-profit trade body for the ITAM industry created to raise the profile of the profession and bring an organisational certification to market. On a voluntary basis Martin is a contributor to ISO WG21 which develops the ITAM International Standard ISO/IEC 19770.

He is also the author of the book "Practical ITAM - The essential guide for IT Asset Managers", a book that describes how to get started and make a difference in the field of IT Asset Management. In addition, Martin developed the PITAM training course and certification.

Prior to founding the ITAM Review in 2008 Martin worked for Centennial Software (Ivanti), Silicon Graphics, CA Technologies and Computer 2000 (Tech Data).

When not working, Martin likes to Ski, Hike, Motorbike and spend time with his young family.

Connect with Martin on LinkedIn.

This is fascinating, Martin. And i think you’re totally on point re. managed services trumping self-management with SAM suites. I think tools are still too often the result of negative audits, which means that organisations expect a silver bullet with quick wins. Once a few quick wins are achieved, some companies become complacent and stop further investment into optimising tools. There’s also the illusion that a competent SAM specialist or team AND a toolsuite shouldn’t require any further investment or resources to optimise. And finally i have encountered that SAM tools are not implemented with the same rigour as, say, ITSM toolsets, thus leaving the SAM specialist/team to attempt technical configuration themselves.

I’m not sure I would agree that 1,000 new customers is weak growth (the adoption growth is not that far off much-hyped cloud technologies). I think many software vendors would kill for such numbers. And I can confirm that Snow’s average deal value is indeed increasing, as is the cross-sell and up-sell as our portfolio widens. We did see several years ago that Gartner estimated a higher growth in “SAM Services” than “tools purchases” and I think this has been borne out over the last 24 months (and will continue). This is actually great news for Snow.

When you consider the limitations of out-of-the-box functionality, subsequent toolset accuracy and greater uptake of cloud-based licensing models over the last couple of years, it’s no surprise that tailored SAM Managed Services are required for effective management of SAP, Oracle and Microsoft licensing and the like.

When you also consider the time required to develop, implement and optimise managed service solutions across the estate for multiple major vendors, it stands to reason that some organisations want to wait and see the results of implementations elsewhere before proceeding with their own.

Therefore, I actually see it as a sign of a maturing market that has greater awareness of the need and benefit of SAM, but realises that tools alone are not the solution.

[…] It’s no surprise, then, that businesses are spending a lot of time, money and effort on this aspect of SAM. However, while the SAM tools market continues to grow, its pace has been slowing significantly since 2016. […]