Research Preview: Diverse approaches taken to SaaS Management by tool vendors

The ITAM Review are undertaking the first in-depth research project into the emerging SaaS Management category. SaaS Management tools and services help companies get to grips with their SaaS spending by discovering spend and reducing waste caused by duplication of services, unused accounts, and poorly optimised contracts. This article shares some initial findings from this research, highlighting a diversity of approach to this complex new area of IT Management.

SaaS Management Research Participants

Participation in the research is open to all providers of SaaS Management tools and services. Current participants are:

If you provide SaaS Management tools and services and wish to be involved in the research, please complete the initial survey. Final date for participation is December 31st 2019.

End User Survey

We want your views too – if you’re an existing user of any SaaS Management tool please complete the end-user survey here.

Initial Findings

The research to date has focused on gathering data on the maturity and approach of the respondents, along with their capabilities in Discovery, Inventory, and Normalisation of SaaS application consumption. Here are some common themes:

Discovery

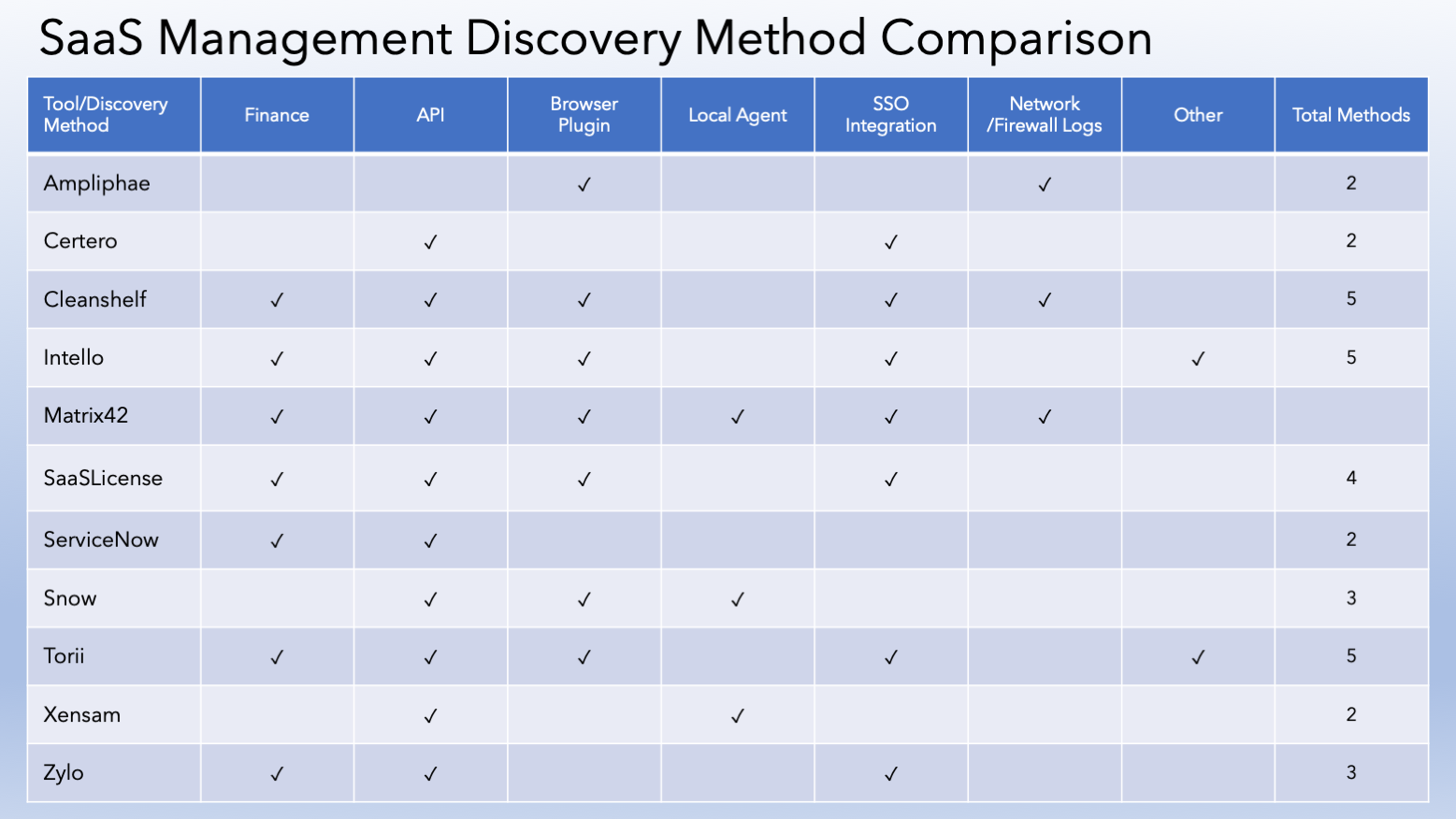

All respondents have multiple discovery methods for SaaS consumption – something we identified as critical for getting a full picture of your SaaS estate.

Of those methods, one stands out as most popular – direct integration with SaaS application portals via APIs. Tied for second is discovery via Finance Integrations, Browser Plugins, and integration with Single Sign On providers such as OneLogin, Okta, and Microsoft Azure AD. On average, the participants in this research use 3 or more discovery methods to get the foundational data required for SaaS Management.

Why are API integrations popular? Quite simply, for SaaS apps that offer them, you’re receiving entitlement and consumption data direct from the source, greatly increasing the certainty you have in your data and thus supporting accurate decision-making. API integrations are configured centrally, don’t require anything to be installed on your clients, and can be up and running and returning rich data within minutes. Sounds ideal? Yes, but it is still reliant on SaaS Application vendors providing a rich API connection to their service, and not all do.

Optimisation Targets

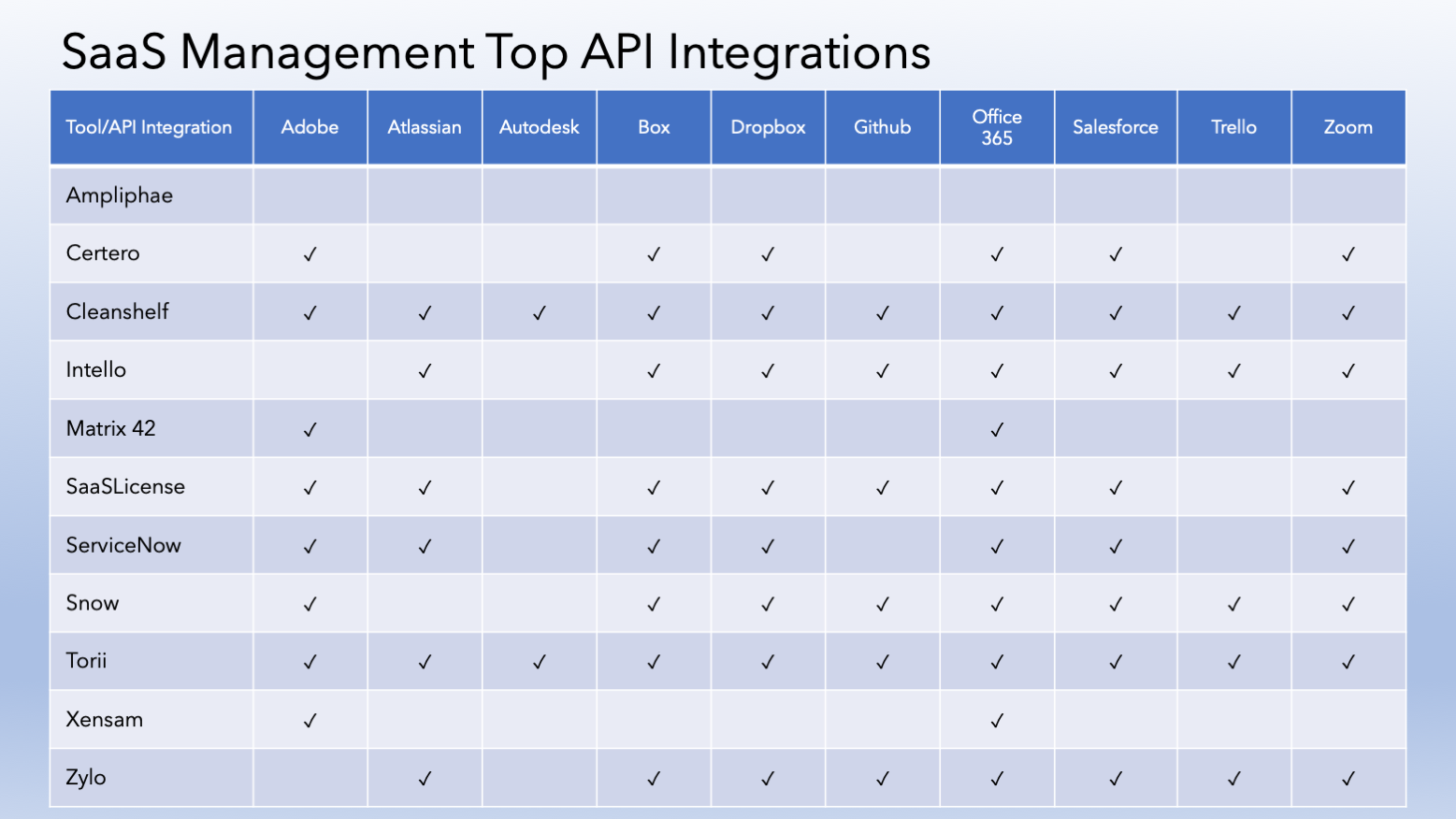

The SaaS application market is in many ways dominated by existing publishers – the top five publishers by revenue are Microsoft, Salesforce, Adobe, SAP, and Oracle. However, there are also a number of new kids on the block, and this is reflected by the direct API integrations provided by the SaaS Management vendors. As noted above, API integrations provide extremely rich data which enable SaaS Managers to make accurate and informed optimisation decisions.

Here, there is a degree of standardisation. Box, Dropbox, Office 365, Salesforce, and Zoom API integrations are available in all the tools offering discovery via API.

For most organisations, Salesforce & Office 365 should be the target for optimisation, simply because they are used so widely and are generally already subject to long-term contracts. Getting renewals right for those two vendors presents the opportunity to “bake-in” long-term savings.

It should be noted that API discovery, whilst the gold standard, isn’t the be-all and end-all of SaaS Optimisation technology. Browser plugins & SSO integrations can also get the usage data that’s essential to delivering against an optimisation opportunity and are useful in situations where APIs return insufficient data, or the SaaS application vendor doesn’t provide an API.

Usage Data

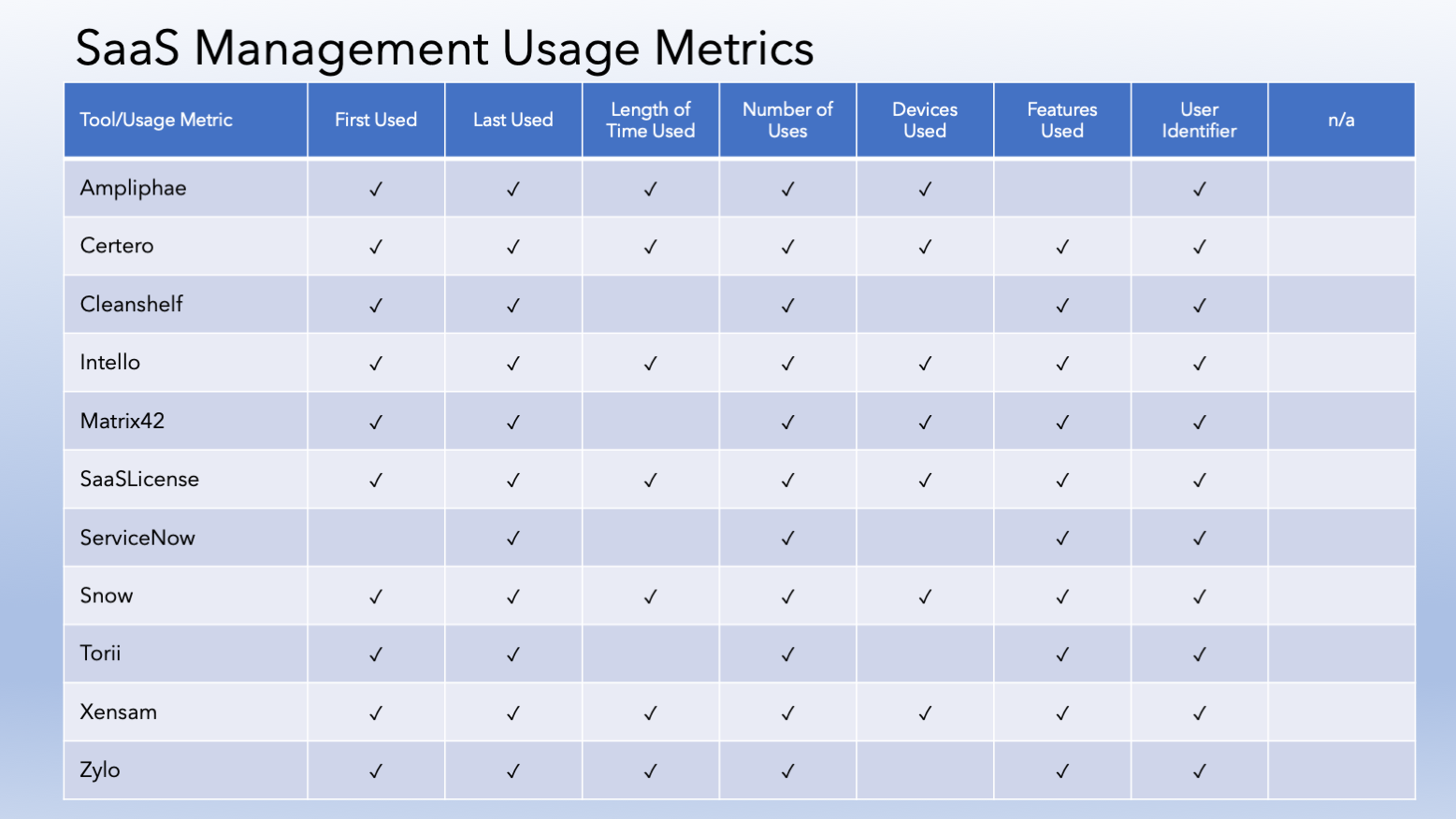

For managers of perpetually licensed software, usage data enables license harvesting to take place. Many of you will have cut your ITAM teeth on harvesting unused MS Project and Visio licenses for example. Usage data for installed software, however, was typically limited. Without sophisticated, but complex, solutions such as key-loggers it was – at best – possible to see when the application was installed, when it was last used, and potentially the number of times it had been used in a given period. The rich data provided by SaaS Management applications provides greater insight into how an application is being used. Nine of the initial respondents are able to discover application usage by feature, and 7 were able to detect the length of time used. This rich usage data can, for example, enable the “downgrading” of a user from a higher edition to a lower edition of an app or suite. Knowing a user opened an application and created a document versus just reading one is key information when making decisions about which tools and editions they need.

Normalisation

Multiple sources of discovery that produce rich inventory data necessitate good normalisation capabilities. Normalisation is the process by which data is combined and cleansed. Key capabilities for SaaS Management apps include integration, connectivity, and categorisation. Integration combines multiple inventory sources into a single asset record. Connectivity ensures that external systems can be used to enrich the data in the SaaS Management tool, while categorisation enables optimisations to be identified for SaaS apps providing duplicate capabilities such as file sharing or web conferencing. All respondents are able to automatically identify the purpose of the app their tool has discovered – for example highlighting that Dropbox, Box, & OneDrive are all being used for storage and file-sharing. You can think of this as an extension to the Software Recognition libraries that are a cornerstone of many “traditional” ITAM tools.

Conclusion

These initial findings highlight that there is still a great deal of diversity in this category. This is normal for such a “young” tool/solution category. What it means for potential consumers of SaaS Management tools is that it’s important to get into the detail when selecting a service. Make sure it fits your use case. For example, if a solution relies primarily on Okta for providing detailed usage data but you don’t use SSO you should be looking elsewhere if usage data is important to you. Similarly, work out which apps are of greatest importance to you and make sure that the prospective solution uses a discovery method such as SSO or API to discover those apps.

Next Steps

This is just a peek at the insights we’re getting from our SaaS Management research. The final research will be published in late February 2020. Please get involved whether you’re a vendor or an end-user. What’s already clear is that this brand-new tool category is maturing rapidly and providing ITAM Managers with the capabilities needed to help us meet present and future challenges around SaaS consumption.

- Tags: Ampliphae · certero · Cleanshelf · Intello · Matrix42 · SaaS Discovery · SaaS Inventory · SaaS Management · SaaS Sprawl · SaaSLicense · ServiceNow · Shadow IT Management · Snow · Torii · Xensam · Zylo

This is great work with the ongoing shift of on-prem acquisitions being overcome by SaaS solutions guidance such as this will play a major part in future tool acquisitions by practitioners

Recently did a similar market analysis against spend detection applications / SaaS manager product offerings. API integration, spend detection, and redundancy recognition are the greatest aspects of some of these service providers