SaaS Optimisation Market Guide August 2019 (update to July 2018 Guide)

Overview

Published 26th July 2018 by AJ Witt.

This Market Guide provides an overview of vendors and products in the nascent SaaS Optimisation & Subscription Management space. The purpose is to provide you with a long-list of vendors to consider if you are in the market for such a toolset. It is non-exhaustive and is based on original research from The ITAM Review. Inclusion on the list does not mean endorsement, and no vendor has received special treatment or priority for their listing. This Market Guide is a free community resource and vendors did not pay for a listing. If you are a vendor not included in the list we will be happy to include you in a future edition.

If you are a customer of one of these tools please consider submitting a review. Reviews can be published anonymously but will be verified by members of the ITAM Review for authenticity.

Market Definition & Analysis

The market under analysis is the SaaS Subscription Management market. This market is focussed on providing organisations with tools to discover, manage, and optimise their SaaS expenditure. Whilst some tool vendors listed in this Guide may offer solutions managing other As-A-Service subscriptions the focus is solely on Software-As-A-Service Subscription Management tools.

Key Findings

This market is evolving quickly. The barriers to entry are low given that most of these tools leverage public APIs for the vendors they seek to manage. Functionality varies from simple discovery of spend through automation of management tasks to advanced optimisation capabilities. No one tool has a clear lead, and you may find that a single tool will not provide all the functionality you require.

Recommendations

In selecting a tool in this space specific consideration should be given to the following areas. These are beyond the standard due diligence approach when selecting a supplier for a service.

- Integration requirements – Many of these tools require integration with Finance & SSO systems. A detailed analysis of these integration methods is beyond the scope of this guide. Prior to selecting a tool ensure that it can integrate with your back-end systems.

- Vendor Maturity – Many vendors are new entrants in this market, typically having been in existence for around 2–3 years at time of publication. Recent acquisitions of VendorHawk & MetaSaaS by ServiceNow & Flexera should be taken into account. Similarly, long-term viability of vendors should be considered. During the course of research for this Guide one vendor (CardLife) ceased trading.

- Privacy – With many of these vendors based in the US, consideration should be given to privacy requirements, particularly with reference to GDPR. For example, if personal use of company devices is permitted in your organisation these tools may risk capturing PII, depending on the discovery method used.

Inclusion Criteria

In compiling this list we have attempted to include vendors from across the marketplace in terms of size, geography, and product capability. If, as a vendor, you are not listed please contact the author for inclusion in a future edition of the guide.

SaaS Optimisation Product Requirements

It is recommended that the product selected is able to deliver the benefits:

- Discovery of SaaS spend – SaaS spend often happens via non-standard channels – for example via employee expenses or departmental budgets outside IT control. A tool should discover this spend category alongside traditional IT contracts.

- Normalisation of Discovery data – A tool should gather data from multiple sources and normalise it to provide a single view of spend with a vendor, categorised by employee, location, department, and so on.

- Optimisation – SaaS Optimisation features include discovery of unused or under-utilised subscriptions along with the ability to action optimisation opportunities through automation – for example automatically switching an employee to the right-sized subscription plan, or on/off-boarding.

- Forecasting & Vendor Management – The fragmented approach to SaaS purchasing often results in multiple contracts for a single vendor, or multiple services which provide the same function. Examples include each department having their own Salesforce contract, or the use of more than one web conferencing service. Tools should identify these deployment cases and provide opportunities for optimisation via co-terming and standardisation, along with forecasting to enable longer-term financial commitments.

Vendors

Introduction

This section provides an overview of each company, with data from a variety of sources.

If pricing is quoted this is the publicly-available price and is based on an organisation size of up to 150 employees. Founding dates and funding information are taken from Crunchbase.

Each listing will outline the discovery method used (see this article for further information on SaaS Discovery methods). Also stated is how the product is deployed (cloud-only, on-prem, both) and whether it is part of a wider ITAM toolset or a pure SaaS tool.

Blissfully were founded in 2016 and are headquartered in New York. They have less than 10 employees and have received $2.6m in funding. They are privately-held.

Blissfully discover SaaS expenditure by integrating with Accounting & Expenses systems, and SSO providers. The product provides discovery and optimisation for SaaS & IaaS deployments and is priced per employee at $32 per annum. It is delivered as a cloud-only standalone SaaS application.

Key differentiators: Offer a free tier, rapid onboarding, great for small businesses.

Zylo were founded in 2015 and are headquartered in Indianapolis. They have less than 50 employees and have received $12.7m in funding. They are privately-held.

Zylo discover SaaS expenditure by integrating with Accounting & Expenses systems, and SSO providers. The product also has direct API integrations with a number of SaaS providers, providing data on product utilisation. The product provides discovery and optimisation for SaaS deployments and is priced per employee. It is delivered as a cloud-only standalone SaaS application.

Key differentiators: The largest of the new entrants, offers managed services in addition to the toolset.

Torii were founded in 2017 and are headquartered in Israel. They have less than 10 employees and have received $1.5m in funding. They are privately-held.

Torii discover SaaS expenditure by integrating with Accounting & Expenses systems, and SSO providers. Additionally, they gather usage information via API integrations with a number of SaaS vendors, and provide a Browser Plugin to capture SaaS usage from company-managed devices. The product provides discovery and optimisation for SaaS deployments and is priced per employee. It is delivered as a cloud-only standalone SaaS application and priced at $34 per employee per year.

Key differentiators: Strong privacy focus, browser plugin, on/offboarding automation.

Snow Software were founded in 1997 and are headquartered in Stockholm, Sweden. They are privately-held and have around 750 employees.

Snow are a full-service ITAM tool provider with SaaS Discovery integrated into their toolset as “Snow for Cloud”. This toolset uses Snow Inventory Manager (part of the on-premises Software Asset Management toolset) along with API connectors for major SaaS & IaaS vendors, including Office 365. Snow for Cloud is not available as a standalone product. Pricing is per device and the Snow platform is available both as an on-premises deployment and hosted with a Snow-approved hosting/added value partner.

Key differentiators: Market presence and maturity, leverage of existing toolset, partner network

Cleanshelf were founded in 2015 and are headquartered in San Mateo, USA. They have 14 employees and are privately-held.

Cleanshelf discover SaaS expenditure by integrating with Accounting & Expenses systems. Discovery via SSO & API is also possible. The product provides discovery and optimisation for SaaS & IaaS deployments. It is delivered as a cloud-only standalone SaaS application.

Key differentiators: Flexible architecture, responsive to customer requirements, benchmarking SaaS spend against other customers. Customer Success teams provide onboarding and optimisation support.

Intello were founded in 2017 and are headquartered in New York, USA. They have less than 10 employees and have received $1.3m in funding. They are privately-held.

Intello discover SaaS expenditure by integrating with Accounting & Expenses systems and SSO providers. Discovery via a browser plugin and granted app permissions is also possible. The product provides discovery and optimisation for SaaS deployments and is priced per employee at $24 per annum. It is delivered as a cloud-only standalone SaaS application.

Key differentiators: Browser-plugin discovery, price.

VendorHawk (ServiceNow) were founded in 2015 and acquired by ServiceNow in 2018. At acquisition they had less than 10 employees and had received $1.3m in funding. They now operate as part of ServiceNow’s Software Asset Management division.

VendorHawk discover SaaS expenditure by integrating with Accounting & Expenses systems, SSO, and API connections. The product provides discovery and optimisation for SaaS deployments and was priced prior to acquisition at $100 per user per annum. Deployment was as a cloud-only SaaS application.

Key differentiators: Integration with ServiceNow platform, market presence

MetaSaaS (Flexera) were founded in 2016 and acquired by Flexera in 2018. At acquisition they had less than 10 employees and had received $2.1m in funding. They now operate as part of Flexera’s Software Asset Management division, with the product sold as Flexera SaaS Manager.

MetaSaaS discover SaaS expenditure by integrating with Accounting & Expenses systems, SSO, and API connections. The product provides discovery and optimisation for IaaS & SaaS deployments and deployment was as a cloud-only SaaS application.

Key differentiators: claim the largest number of direct integrations in the market; benefit from Flexera’s market presence.

Alpin were founded in 2013 and are headquartered in Boulder, Colorado, USA. They have less than 10 employees and have received $1.9m in funding. They have had a SaaS Optimisation product since 2017 and they are privately-held. Their background is IT Security, having developed a password-less authentication product, and this informs their approach to the SaaS Optimisation market.

Alpin discover SaaS Expenditure through integrations with Expenses, Accounting, APIs, Proxies, Firewalls, Email, and a browser plugin. Deployment is as a cloud-only standalone SaaS app.

Key differentiators: Strong focus on IT Security & Compliance aspects of SaaS Optimisation, including application blacklisting and data loss prevention. Wide range of discovery technologies.

Certero were founded in 2007 and are headquartered in Warrington, UK. They are privately-held and have less than 50 employees.

Certero are a full-service ITAM tool provider. AssetStudio for Cloud can be run standalone or alongside their other AssetStudio products. Discovery is performed via an agent or API connection and the solution supports Office 365, Azure, & AWS. The product is delivered either via the cloud or on premises and is available via partners and as a managed service.

Key Differentiators: Integration with existing ITAM toolset, partner network, flexible cloud-ready architecture.

Eracent were founded in 2000 and are headquartered in Pennsylvania, USA. They have around 80 employees. They target the enterprise sector.

Eracent are a full-service ITAM tools provider and have SaaS Management modules integrated into their Continuous License Reconciliation & IT Management Center product suites. The Cloud Optimisation product discovers IaaS & SaaS usage via direct integration, on-premises agent, and URL mapping. It is delivered as an on-premises application.

Key Differentiators: Enterprise scale provider with broad coverage of all ITAM tool requirements, “single pane of glass”, maturity.

Siftery were founded in 2015 and are headquartered in San Francisco, USA. They have less than 50 employees and have received $4.1m in funding. They are privately-held.

Siftery discover SaaS expenditure by integrating with Accounting & Expenses systems and SSO providers. Discovery via API integrations is also possible. The product provides discovery and optimisation for IaaS & SaaS deployments and is priced per employee at $52 per annum. It is delivered as a cloud-only standalone SaaS application.

Key differentiators: Rapid on-boarding, includes AWS optimisation

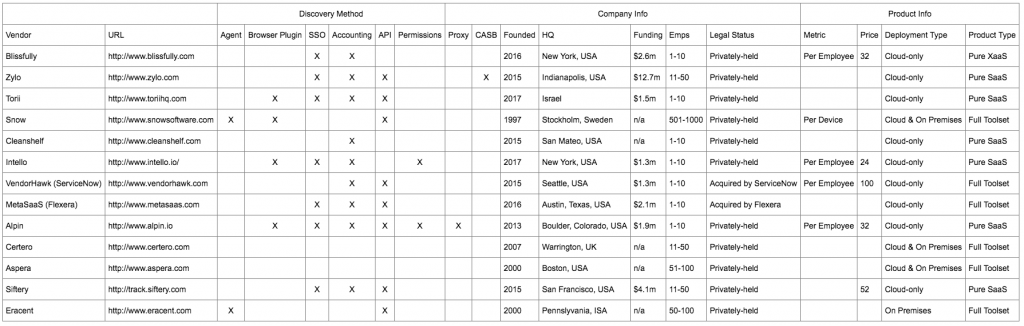

Summary Data

The above vendor content is summarised in the following table (click to expand)

Conclusion

This market guide highlights that there is considerable variance in approach to SaaS Optimisation. Large vendors have approached the problem either by applying their on-premises technology or acquiring startups. There are a number of startups with very similar products discovering usage via SSO and Accounting integrations and these are largely differentiated based on price and long-term viability. New entrants taking a different approach through the use of Browser Plugins and direct integration potentially have an edge over those startups.

There is a wide variance in price and added value service level.

Supplier selection in this market is relatively low-risk – most services, particularly from the new entrants, are purchased as a subscription and startup costs are minimal. This makes it perfectly feasible to try multiple vendors, and potentially even run a live competitive bid process side by side.