Market Share Analysis for SAM Tools

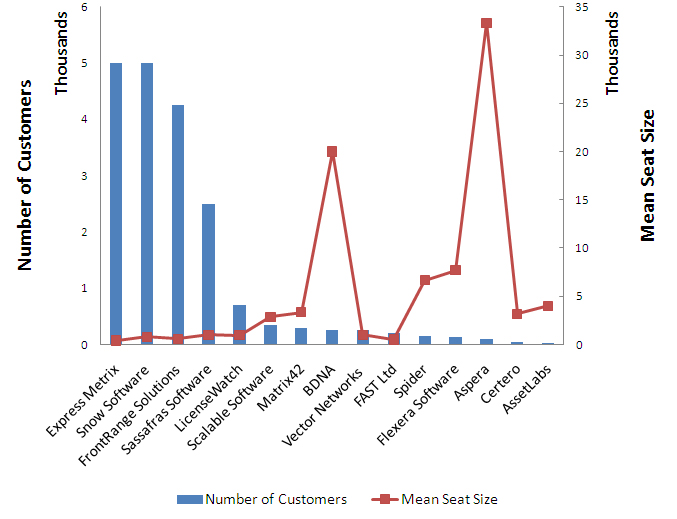

The graphic above provides a snapshot of the key players in the SAM tools market in terms of the number of customers (Blue bars) and the average size of their clients (Red dotted line). So as an example LicenseWatch have 700 customers who manage a total of 680,000 seats giving them an average customer size of 971.

As you can see, four vendors have in excess of 2,000 customers each, followed by a list of vendors with smaller customer counts. In terms of average customer size, there are a couple of spikes from BDNA and Aspera who have relatively low customer counts but tend to engage with larger customers.

Full details on number of customers, devices under management, further analysis and an independent rating for each vendor are included in TOOLS INTELLIGENCE from The ITAM Review.

Limitations

- Data is based on vendor estimates and has not been independently verified. It would be interesting to see which customers were on maintenance, how many were actively using the tool etc

- Notable exceptions with larger customer counts missing from this data include HP, CA, IBM, Symantec Altiris, Novell Zenworks (although there is considerable overlap regarding what is considered SAM here – see below).

Defining The SAM Market

It is notoriously difficult to estimate market share and penetration in the SAM market. Gartner tend to only focus at the top end of ITAM, and Forrester clumps the market together into a market they define as ITALM – which includes systems management.

SAM is still considered niche. It is a discipline that can be traced back to the creation of licensing but in the grand scale of things it is very much in its infancy, especially in terms of adoption.

A further complication is that SAM is often bundled along with other bits and pieces making it difficult to determine usage. It’s much like trying to determine the consumption of gherkins by the number of Big Macs that are bought – it’s in there, but is it eaten?

There is also market confusion over what constitutes a SAM tool. Many vendors position themselves as having SAM functionality whereas, in my opinion, in reality it is systems management or inventory. This becomes even more clear when compared to some of the SAM functionality and innovation being delivered by the vendors in this report.

As the market matures and the practice of IT Asset Management grows as a business discipline this difference will become more apparent. In my view the differences is defined by the fact that inventory and systems management are a technical or service function, SAM is a business function.

Reasons to Be Cheerful

Despite the limitations and omissions in the analysis the message is clear – the growth potential in the SAM software market is ENORMOUS. Total desktops under management across all the vendors (full details of which are in the report) is a drop in the ocean in terms of market penetration.

The report will be published at the end of October / Start of November 2010 – please subscribe to The ITAM Review newsletter to be notified when it is published.

About Martin Thompson

Martin is also the founder of ITAM Forum, a not-for-profit trade body for the ITAM industry created to raise the profile of the profession and bring an organisational certification to market. On a voluntary basis Martin is a contributor to ISO WG21 which develops the ITAM International Standard ISO/IEC 19770.

He is also the author of the book "Practical ITAM - The essential guide for IT Asset Managers", a book that describes how to get started and make a difference in the field of IT Asset Management. In addition, Martin developed the PITAM training course and certification.

Prior to founding the ITAM Review in 2008 Martin worked for Centennial Software (Ivanti), Silicon Graphics, CA Technologies and Computer 2000 (Tech Data).

When not working, Martin likes to Ski, Hike, Motorbike and spend time with his young family.

Connect with Martin on LinkedIn.

Market share figures are global NOT

UK specific.

Hi Martin, do you have a similar graph for 2012? Thanks.

Coming soon

https://marketplace.itassetmanagement.net/2012/03/26/coming-2012-sam-tools-review/