The Dos and Don’ts of ROI

Kylie Fowler

This article has been contributed by Kylie Fowler. Regular columnist and Analyst at The ITAM Review.

My last article ‘Calculating Return on Investment’ discussed how to calculate the ROI of an ITAM Programme. This follow-on article looks at some of the Dos and Don’ts of using ROI in an ITAM environment.

Return on Investment – What is it?

Return on Investment is a way of measuring the success of a particular investment in time, resource or money. In much ITAM related literature it is used to justify investment in an ITAM programme, however it is also beneficial in measuring the improvement of different ITAM activities over time and evaluating the long term impact of different choices, for instance whether to automatically harvest unused software or whether to obtain users permission before uninstall.

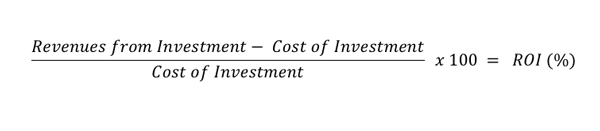

Just to remind you, the basic equation is

But bear in mind the importance of discounting the cash flows over time to take into account the effect of inflation on both the benefits and costs.

Keep in mind the big picture

- DO align your ROI measurements to your overall business objectives – first and foremost, focus on the benefits the business wants your ITAM programme to achieve rather than fringe benefits that aren’t really important to the business, for instance hardware ever-greening in a non-technology intensive business

- DO calculate ROI for specific elements of your ITAM programme – for instance software harvesting and re-use

- DON’T just consider ROI to be a tool for justifying an ITAM Programme. You should also measure the ROI of your IT Assets themselves.

- DO consider the calculation of ROI for specific applications and technologies to be a core function of a mature ITAM programme. This is critical management information that will help guide IT investment decisions over time.

- DO measure the ROI of different scenarios over different time periods eg calculate the ROI of your desktop hardware for refresh periods of 3 vs 4 vs 5 years. The different results will provide guidance for specific decisions and provide a baseline for changes in the future

Be consistent in your assumptions

- DO spend some time identifying the assumptions you will need to make to calculate both the ‘revenue’ and ‘cost’ sides of the equation

- DO ensure your assumptions are consistent and realistic.

- DO outline your assumptions when presenting ROI calculations to management

- DO use the same assumptions over time – don’t change them every time you do a new ROI calculation. If they need to change, document why and the effect this will have when comparing older ROI calculations

- DO ensure the assumptions used align with those used commonly elsewhere in your organisation – for instance, organisations often have a standard discount rate used to calculate Present Values, and there are often Full Time Equivalent (FTE) rates for calculating the cost of employees’ time.

Use ROI to support your ITAM programme

- DO use ROI as a retrospective measure – calculate the costs and benefits of your SAM programme for the last year, for instance, rather than just using it to justify investment in future activities

- DO use ROI to measure improvement – measuring the ROI regularly year after year and showing an increasing rate of return is a very powerful way to justify existing activity and build the case for more investment

- DO measure the same things in the same way every time you calculate ROI

- DO use ROI calculations to support individual elements of your business case eg hardware disposal activities

- DON’T make ROI calculations the centrepiece of your business case – there are many benefits of a SAM Programme that are almost impossible to measure for the purposes of calculating ROI

- DO recognise that ROI is sometimes the wrong metric. Sometimes you will need to focus on qualitative rather than quantitative information, for instance when discussing the impact of reputational risks on the business

Use ROI to measure success

- DO your homework before launching into the calculations. What does success look like? How do we measure it at the moment? Only then should you work out how these measurements fit into the ROI equation

- DO ensure all your stakeholders agree what success looks like and how it should be measured to ensure your calculations are comprehensive

- DON’T overstate the benefits – there will be many ITAM activities where the benefits overlap and it is easy to fail to properly isolate the benefits of individual activities. The result is the benefits as a whole will be overstated for each ROI calculation. This applies equally to the costs as well!

- DON’T underestimate the costs – ensure you talk to all your stakeholders to identify ALL the impacts of the activity or change

- DO be rigorous and consistent when estimating the proportion of overall costs and benefits that should go into each calculation. Ensure you are consistent both between different calculations and over time

…. and finally

DO expect management to be sceptical about high ROI figures. They know the dramatic effect different assumptions can have on an ROI calculation and how easy it is to underestimate costs and overstate benefits. Be prepared to defend both your assumptions and the rigour of your cost and benefit assessments.

This article has been contributed by Kylie Fowler. Regular columnist and Analyst at The ITAM Review.

Related articles:

- Tags: Business Case · cost benefit analysis · kylie fowler · rate of return · ROI · roi calculation

About Martin Thompson

Martin is also the founder of ITAM Forum, a not-for-profit trade body for the ITAM industry created to raise the profile of the profession and bring an organisational certification to market. On a voluntary basis Martin is a contributor to ISO WG21 which develops the ITAM International Standard ISO/IEC 19770.

He is also the author of the book "Practical ITAM - The essential guide for IT Asset Managers", a book that describes how to get started and make a difference in the field of IT Asset Management. In addition, Martin developed the PITAM training course and certification.

Prior to founding the ITAM Review in 2008 Martin worked for Centennial Software (Ivanti), Silicon Graphics, CA Technologies and Computer 2000 (Tech Data).

When not working, Martin likes to Ski, Hike, Motorbike and spend time with his young family.

Connect with Martin on LinkedIn.

Hi Kylie,

Great article!

In many cases you also might want to include the Total Cost of Ownership (TCO) of the assets in order to get a more precise result. For example if you purchase an asset worth €1000 that can save you €500 on optimization, but the maintenance and support costs are additionally €1000 over 3 years, you would potentially have a TCO of €2000 which would give you a ROI of 25% instead of 50%.

Hi Patrick,

Glad you like the article.

You are right that TCO is important, however if you are thorough in your calculations, TCO is automatically included in the ROI – because you should be including all your costs as a matter of course.

The important thing is to be consistent in the way you calculate ROI because the real value comes in comparing ROI over time and across different activities in order to allow you to prioritise where you should invest your time and resources for the best return.

Thank you for sharing.

I’d appreciate it if you can also show us an example; a study of sorts. I’d like to see how you put apply the DOs and Don’ts in an equation.