Realizing Authentic License Optimization

“There’s no silver bullet for a discovery tool”

Ahead of the SAM Summit taking place in Chicago, 23-25 June, I chatted to Bernhard Boehler, Co-founder and CEO at Aspera Technologies. In this interview Bernhard discusses Aspera’s new Optimization & Simulation Module, and how license management has become too complicated for manual calculations and spreadsheets.

Please could you provide us with a brief overview of your experience and current role?

For more than 14 years I have been the Co-founder and CEO of Aspera. As CEO I help set and monitor company goals, including overseeing the overall growth of Aspera, and I report to the USU board. With 15 new hires and three Fortune 100 companies as new customers in the last two quarters alone, I have a lot of good news to report to USU!

What are the key features of the Optimization and Simulation Module?

In a nutshell, the Optimization & Simulation Module (OSM) picks up where other technologies leave off and puts at your fingertips the necessary information to go beyond compliance and discover new strategies for your SAM program.

It offers out-of-the-box reports and features that help you analyze different licensing options, and then determine the effects of an ever-changing infrastructure on the demand for licenses.

With this valuable information users can:

- Simulate the effects of different server, virtualization, and cluster scenarios on the license demand

- Recommend changes to the operational environment in order to reduce the demand for licenses

- Compare alternative licensing models to immediately the see most cost-effective option

- Optimize budget planning and preparation for true-ups and contract renewals

- Improve the compliance position in an audit by understanding the available licenses owned by the company

How would you suggest an organization assess licensing models to ensure they use the correct one?

The mistake most organizations make is to only focus on the monetary aspect. Don’t get me wrong–this is an extremely important part of choosing the correct licensing model. But the correct license model is not only cost-effective – it’s measurable, too! Most organizations first purchase the software licenses, install the software, and then try to gather the necessary data for license management. This process needs to be turned upside-down. Once a need for new software is established–but before the licenses are purchased–IT needs to determine how it can manage the software. What effective SAM comes down to is: Don’t buy it unless you can track the metric!

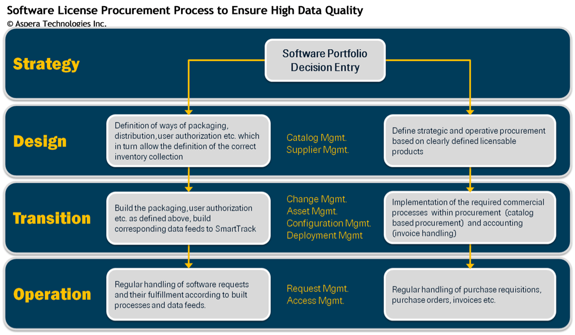

Three years ago, in 2011, Christof Beaupoil published an article on Network World’s website, “How to measure data quality and protect against software audits,” that ended with basically this same message. He even sketched up a process framework to ensure better data quality:

What constitutes the ‘SAM Sweet Spot’?

The SAM Sweet Spot is different for every organization. Most companies strive for compliance and set that as their sweet spot. After they master Compliance Management, they look towards Strategic License Management, at which point their sweet spots shifts to deeper process integration with ITSM and Server License Optimization.

I think the sweet spot is reached when a SAM program is able to concretely demonstrate the monetary benefits of its activities; and that this evidence does not have to be manually researched and prepared – it’s automatically and permanently supported by established processes and tools.

What are the current trends regarding license optimization and the correct models?

Since the founding of Aspera in 2000 the market has benefited from traditional forms of “License Optimization” such as automatically utilizing product use rights, the most ones being: downgrade rights, parallel use rights, secondary copy rights, and product bundles. The result is a reduction in the demand for licenses while being able close over-and-under-licensing gaps. Traditional License Optimization focuses heavily on desktop software and starts and stops with compliance. It has become, so to speak, the standard approach of every respectable SAM Tool.

Today’s optimization trend goes beyond the desktop and in to the data center – Server License Optimization or Next Generation License Optimization, if you prefer. It uncovers new strategies for your SAM program–beyond compliance–by handling the data as it truly is—that is: dynamic and changing. It explores all options and answers questions such as:

- Would another license type be less expensive?

- What server configuration is most optimal for the existing licenses?

- How does a change in the architecture or configuration (e.g. as a result of Service Management procedures) impact the licensing costs?

- Which contract model is right for the company’s future software use?

As a result, enterprise SAM becomes a two-way street. It is an active, strategic, component of IT Service Management, offering vital license-cost-analyses for server configurations and virtualization, thereby supporting IT contract and procurement planning, and portfolio management.

What are the benefits of having your existing license inventory and your long-term strategic demand plans simultaneously optimized?

This requires the SAM Tool to analyze a company’s existing licenses and their compatibility with the current operational environment while simulating changes in the data center architecture and configurations. Our customers have told me about the following advantages:

- Highlighting red flags when the licensing is no longer optimal for the operational environment, due to changes as a result of configuration management or ITSM procedures

- Immediate savings by purchasing only the best fitting and most cost-effective licenses

- Cost avoidance by efficiently using existing contracts and licenses in order to reduce the gap results of a true-up, thereby avoiding new purchases

Over time this process of Strategic License Management enables strategic sourcing to use SAM to optimize their purchasing thus optimizing the license inventory to best meet the demand for licenses. Strategic License Management also endows SAM Managers with license-cost-analyses and recommendations for hardware configurations that reduce the demand for licenses (Demand Optimization), and positively impact the IT bottom-line.

There’s no catch to any of these benefits – just well thought-out processes focusing on high data quality, integration with multiple data sources, and publisher-specific license expertise.

How important have tools become in helping organizations manage their software assets?

Tools are and have always been important for organizations to manage their software assets. It started with enterprising implementing discovery tools to track software installation and integrating immense ITAM suite technologies.

With the invention of SKU and catalog-based license management technology in 2000, the SAM Tool market simply got more sophisticated, and the measurable value derived from these new license management tools made their impact all the more noticeable.

Why do you think that is the case? What has been the cause for the recent up-take of tools?

With the advent of virtualization–cloud computing and widespread adoption of mobile platforms–managing enterprise software assets requires more than a spreadsheet and part-time attention. Software audits are a constant threat, requiring audit response procedures and full-time attention. The consumerization of IT and increasing demand for BYOD policies means that employees use multiple devices – smartphones, tablets, laptops, home computers – and companies find themselves asking the million dollar question, “How many licenses do we need?”

In other words, license management becomes too complicated for manual calculations and spreadsheets. And because the ITAM suites don’t adequately cover the license piece of software assets, enterprises reach their limits and Software Asset Management comes to a halt unless companies implement a specialized SAM Tool.

There isn’t a ‘silver bullet’ tool as you say, so how would you suggest an organization use a tool to ensure true license optimization?

Indeed there is no silver bullet for a discovery tool. Each software publisher requires a different set of data to manage its license metrics. This means that no single discovery tool is able to collect all of the required data for license metrics within a typical SAM scope. Integrated discovery tools in suite products are generally designed to perform desktop scans and superficial server inventory.

However, for the Server License Optimization, configurations are paramount (e.g. for IBM, user profiles for SAP, and database settings for Oracle) as well as virtual machine to host device relationships. The majority of integrated discovery tools do not collect this required information and additional tools and scripts are required.

Thus, Software Asset Management requires several discovery tools so the focus should be on the SAM Tool provider’s experience with integrating to existing discovery tools in your environment, specifically:

- To which discovery tool does the provider offer out-of-the-box (OOTB) connectors, and can your ITAM, ITSM, CMDB, and Procurement systems also be integrated OOTB? The key for standardization is to require as little customization to the SAM Tool as possible.

- Does the SAM provider have the expertise to extend the capabilities of your existing technologies to get the required data for key metrics?

- Does the provider have publisher-specialized knowledge to create additional scripts to collect any missing, but necessary data?

What data-sets would be required for an organization to establish the right licensing model?

You need information about the operational environment, where the software is running including configuration information, virtualization topologies, and product and metric specific discovery data. Most people don’t think of this next required data-set right away, but price information is indispensable to a cost-analysis. Whether the company uses its own payment/invoice data or publisher price lists, this data is a must to find the right licensing model. And finally, you need data about the licenses themselves, and how their metrics and rules work within the operational environment.

Would be interesting to see how Aspera Technologies compares to the other SAM tools out there on the market.