Cloud still driving software vendor revenues

Software vendor financial results can be more interesting for ITAM & SAM managers than they might first appear. Looking at how the software vendors are performing on a quarterly and annual basis can give the savvy organisation some good insight. Who is likely to increase audits? Where might good discounts be found? What upcoming business model changes might impact us? Hints to potential answers for questions like this, and more, can be answered by taking a look at the vendor’s results. It’s clear that cloud is still driving software vendor revenues – but by how much?

In this article, we look at the most recent results for:

Amazon AWS

Amazon announced their results for Q3 (July – September 2020) and AWS showed net sales of $11.6 billion – up 29% – and operating income up a huge 52% to $3.5 billion. 29% growth is impressive, particularly for the market leader, but it does represent a second consecutive quarter of sub-30% growth which is a low for Amazon AWS.

They talked up several customer wins including Jack in the Box, Indeed, Best Western, DXC across a range of product areas such as storage, graphics rendering, IoT, machine learning, contact centres and more. Among the various new product launches was “AWS Nitro Enclaves” – a new offering that enables secure processing of “highly sensitive data” in the cloud.

Further reading

Google Cloud

Alphabet’s Q3 2020 saw Google Cloud revenue of $3.4 billion – a 45% increase year on year. Sundar Pichai, Google CEO, attributed this to three things:

- Their technologies in areas such as data processing, machine learning, and analytics

- Organisations moving to the cloud to reduce costs

- Ongoing remote collaboration requirements

The second point catches my eye – we can have a very interesting discussion about whether moving to the cloud actually saves you money…certainly not immediately. It opens up huge possibilities and allows you to modernise, uncover new potential, and find new revenue streams etc. but if you’re spending “x” on-premises, just moving it to the cloud and expecting it to be cheaper is a recipe for disappointment.

Ruth Porat, Google CFO, stated that they “intend to maintain a high level of investment, given the opportunity [they] see”

Pichai also revealed that from Q4 2020 (next quarter), they will be breaking Google Cloud out as a separate reporting segment. This means we will get more detailed information about where exactly the revenues are coming from – including operating income for each of the segments – and this will also be backdated to 2018.

Further Reading

Google results

Earnings call transcript

IBM

IBM’s results for Q3 (July – September) 2020 saw overall revenue drop 2% to $17.6 billion although total cloud revenue was up 19% to $6 billion – driven by a 20% increase within “Cloud & Data Platforms”…which contains Red Hat. There were further decreases across the business:

- Global Business Services revenue was down 5% to $4 billion

- Global Technology Services revenue was down 4% to $6.5 billion

- Systems was down 15% to $1.3 billion

It’s clear that overall IBM are struggling, but equally clear that cloud stands out as a shining star. IBM’s desire to focus on cloud was most recently demonstrated by their recent announcement to spin out their Managed Infrastructure Services division.

They have a job ahead of them and it will take a fair amount of time and many careful manoeuvres, but it could well be that IBM are on the right road. If you’re an IBM customer and not in their cloud – expect them to try really hard to change that! We’ve seen the start of that with recently announced price increases.

Further reading

Microsoft

Microsoft continue to have a very strong 2020 as their Q1 FY21 results show. For the 3 months July/August/September 2020, Microsoft’s numbers were:

- Revenue up 12% to $37.2 billion

- Operating Income up 25% to $15.9 billion

- Net Income up 30% to $13.9 billion

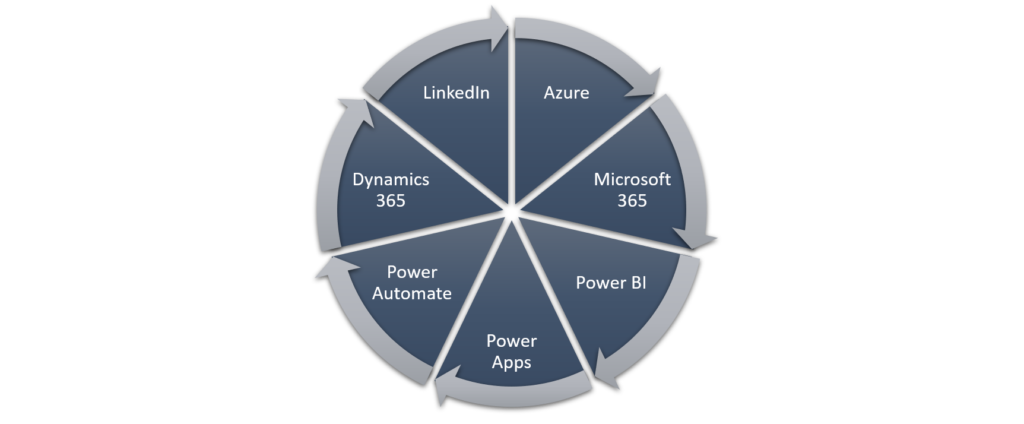

The Commercial Cloud business was up 31% YoY while Azure grew at 48%. As you can see throughout this article, Microsoft are having a much better time of it than their traditional “tier 1” rivals and that is primarily due to the breadth of Microsoft’s product portfolio which includes:

This enables Microsoft to be relevant to a broad range of customers with a broad range of challenges and aims for 2021.

This period of time is, I think, going to be hugely significant for Microsoft’s future. They have the chance to become an integral partner to 1000’s of businesses across the globe – not just through the products they sell but also the advice and support they offer. Helping organisations design and execute their digital transformation strategies allows Microsoft to shape their 5-10-year plans to best suit them, rather than competing technology providers. Satya Nadella’s Microsoft have already been doing well but COVID-19 may well be a significant opportunity for them to win new business and the hearts and minds of users and executives while they’re at it.

Further reading

Oracle

For their first quarter FY21 (June – August 2020), Oracle reported:

- Overall revenue – up 2% to $9.4 billion

- Cloud services & license support revenue – up 2% to $6.9 billion

- Cloud license and on-premises license revenue – up 9% to $886 million

CEO Safra Catz and Chairman Larry Ellison talked up their cloud capabilities and growth (again):

“I think Zoom is a great example because it proves that the Oracle Cloud is secure, reliable, high performant and economical…That was just purely an evaluation of our cloud versus Microsoft’s versus Google’s versus Amazon’s.”

They now have a webpage listing the various customers they are adding to the cloud – https://www.oracle.com/customers/earnings.html

It was also interesting to see Ellison talk about their licensing strategy in the cloud:

“I think our license business is really misunderstood. People think our — they see license business and they translate in their brain, license means on-premise[s]. That is not true for us. It may be true for everybody else, by the way.

We have this thing called bring your own license to the cloud…So you cannot look at our growth and our database license business and say that’s…a revival of the old on-premise[s] business. That is not correct”

It was pointed out on the earnings call that this is the first quarter for a long time without a decrease in the hardware business and Catz said:

“Revenue in Exadata was up 15%; bookings in our strategic hardware, also up very, very high double digits. And we have actually an enormous Exadata backlog, really the largest — it’s actually double what it was — more than double what it was last year.”

Larry Ellison made a statement which bears some examination:

“… Oracle occupies a unique position in the cloud market. Oracle is the only cloud vendor that competes in both the enterprise applications market, SaaS, and the infrastructure-as-a-service market, IaaS”

I know there can be various definitions of some of these terms, but I’d be keen to understand how Microsoft (at least) don’t also span all those areas too?

Overall, an increase is an increase – particularly in 2020 – so Oracle appear to be getting something right. They are very bullish on their cloud products and their future growth – let’s see how they get on throughout the rest of FY21.

Further reading

Oracle results

Oracle call transcript

SAP

SAP posted poor results in Q3 2020 and revised down their guidance for FY20 & FY21. Revenue was down 4% to €6.5 billion & Operating Profit was down 12% to €1.5 billion. At time of writing (early November) the share price has fallen 25%. From their analyst call it’s clear that they don’t expect the situation to improve until 2023 – they took the unusual step of talking about 2025 revenues, which is when they expect to have returned to double-digit growth.

This is quite a turnaround for a company that seemed to be navigating the shift to Cloud reasonably well, in comparison at least to other ERP vendors such as Oracle.

So, what’s gone wrong?

The most immediate impact has been the global slowdown caused by COVID-19. SAP’s core customers will no doubt be postponing major cloud investments whilst they take stock of their own business outlook. Retail, Hospitality, and Travel are important sectors for SAP…and they’ve been worst hit by the economic impact of coronavirus.

However, that’s the case for many other software publishers too, and we’re not seeing big falls in their share prices. What else is making investors jittery?

This external shock has also come in a period of boardroom transition for SAP. First up, Bill McDermott left for ServiceNow in autumn 2019. He was replaced by co-CEOs Christian Klein & Jennifer Morgan. Klein then became sole CEO in April 2020, with SAP claiming that the impact of coronavirus required quicker decision-making. Losing a proven winner such as McDermott will always unsettle investors, but to then change tack so quickly smacks of confusion and a lack of clear strategy. With these results any honeymoon that Klein was enjoying is long gone.

It’s not all gloom though. The next two years are clearly going to be challenging for SAP, but they have a loyal customer base who won’t be going anywhere. They may be delaying their move to S/4HANA but they’re unlikely to decide to switch ERP providers. It’s a case of “sit tight and ride out the storm” and it’s something they can probably afford to do.

For IT Asset Managers the key concern will be whether SAP go on a revenue hunt through increased audit activity. As always, it’s best to be prepared for both audit activity and sales tactics designed to lever you towards the cloud subscription products. However, they’ve already got the bad news out of the door, the adjustment in expectations has already taken place, and so perhaps that isn’t a priority for them.

Further reading

Conclusion

Cloud is still the name of the game. On-premises licensing is flat or negative pretty much across the board while cloud services, both SaaS and IaaS, are flying off the virtual shelves. Amazon AWS and Microsoft Azure are both still growing, although at a slowing pace, and Microsoft are growing at a higher percent that Amazon, albeit it on a smaller base.

Cloud certainly appears to be the saviour for many vendors so if you, as a customer, aren’t helping them in that recovery by purchasing cloud services – there’s a high chance they will look at ways to change that! Awareness of vendor’s cloud roadmaps and how this matches up to your organisation’s plans will be key when negotiating renewals and new agreements.

Related articles:

- Tags: Amazon AWS · Google Cloud · IBM · Microsoft · Microsoft Azure · Oracle · Oracle Cloud · SAP · Software vendor financial results

About Rich Gibbons

A Northerner renowned for his shirts, Rich is a big Hip-Hop head, and loves travel, football in general (specifically MUFC), baseball, Marvel, and reading as many books as possible. Finding ways to combine all of these with ITAM & software licensing is always fun!

Connect with Rich on Twitter or LinkedIn.

Thanks for a great article Richard. It would be great if you could add to this by suggesting how organisations can exploit any opportunities these results provide. Ie, being able to negotiate harder on certain product lines with SAP given their recent struggles etc..