Software vendor financial results – August 2020

Software vendor financial results can be more interesting for ITAM & SAM managers than they might first appear. Looking at how the software vendors are performing on a quarterly and annual basis can give the savvy organisation some good insight. Who is likely to increase audits? Where might good discounts be found? What upcoming business model changes might impact us? Hints to potential answers for questions like this, and more, can be answered by taking a look at the vendor’s results. We’re seeing more information around the impact of the Coronavirus outbreak.

In this article, we look at the most recent results for:

See the previous round-up here.

Amazon AWS

Q2 FY20

In Q2, Amazon AWS sales rose 29% to $10.8 billion and operating income increased 58% to $3.4 billion, with CFO Brian Olsavksy stating that AWS is a $43 billion “annualized run rate business” with an average contract length of “over three years”.

He also stated that Amazon are working with customers to help reduce spend including “scaling down the usage where it makes sense”. It’s a great move to help customers reduce their cloud spend during the current economic climate – I wonder if this will continue to be offered to customers even when COVID-19 is under control and things are back to normal less bizarre?

Further Reading

Google Cloud

![]()

Q2 FY20

Google Cloud, which contains both Google Cloud Platform (GCP) and G-Suite, rose to just over $3 billion, an increase of 43% YoY. GCP growth was driven by infrastructure and data analytics while G-Suite maintained “healthy growth” in average revenue per seat and number of seats.

Sundar Pichai, CEO of Google, believes they are “undertapped” [sic] when it comes to cloud potential and this is reflected in their increased activity in hiring new people, increasing the marketing, building new datacentres, and more. Google are definitely gearing up to take the fight to Amazon and Microsoft, so I’d expect lots of sales contact etc. from them out to customers – both existing and potential. If you’re already a customer or are considering Google cloud, just like with the other vendors, think about where you can use their eagerness to grow to your advantage.

Further reading

IBM

Q2 FY20

Revenue was $18.1 billion, a decrease of 5.4% – although IBM report this would be 1.9% if adjusted for divested businesses and currency changes. Revenue estimates from analysts were around $17.7 billion so this result was well received as being better than expected.

Total cloud revenue increased 30% to $6.3 billion while Red Hat was up 17% but IBM’s “Russian doll” approach to cloud makes it a little tricky to get the full picture – for example ‘Cloud & Cognitive Services’ includes ‘Cloud & Data Platforms’ – which includes Red Hat. When we look at the overall results – ‘Cloud & Data Platforms’ was up 29% while the parent division ‘Cloud & Cognitive Services’ was up just 3%.

Away from the cloud, the ‘Systems’ division saw revenue of $1.9 billion (a 6% increase), led by a 69% increase in IBM Z – an area which saw significant licensing changes last year.

Overall, these Q2 2020 results are pretty positive for IBM. Although revenue is down, Wall Street is happy, and the cloud business is going in the right direction. The pricing changes in June 2020 will likely continue to drive an increase in cloud revenue, as on-premises installations start to become more expensive.

Further reading

Micro Focus

Q2 FY20

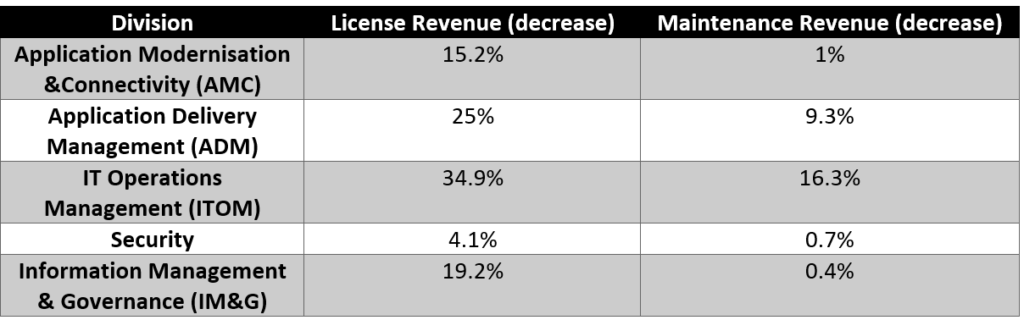

Another disappointing performance for Micro Focus as revenue declined by 11.3% YoY for the first half of their financial year – up to April 30, 2020. Licenses were down 21.3%, consulting by 14.8%, SaaS by 12.7%, and maintenance by 7.7%.

Broken out across the product portfolio, it looks like this:

They report disruption to the new projects pipeline, as well as “pressure” around the size and timing of maintenance renewals, which is expected to account for 2% of the revenue drop.

The Micro Focus report states that “the Group” is 5 months into a 3 year “turnaround plan” which involves structural changes to the business. When Micro Focus acquired Attachmate in 2014, the latter’s parent company – Wizard Parent LLC – gained a 40% stake in Micro Focus. Wizard Parent LLC is comprised of four investment groups:

- Elliott Management

- Francisco Partners

- Golden Gate Capital

- Thoma Bravo

Based on past activities and their involvement with several other technology companies, it is likely they are quite involved in helping shape the future direction of Micro Focus.

Further reading

Microsoft

FY20

June 30th was the end of Microsoft’s Q4 and thus their financial year known as FY20. Q4 was very positive with revenue increases in all the right places:

- Office 365 = 19%+

- Dynamics 365 = 38%+

- LinkedIn = 10%+

- Azure = 47%+

All of which took their ‘Commercial Cloud’ division to $14.3 billion revenue for Q4, and a total of $51.7 billion for the whole financial year. Total figures for the financial year were revenue of $143 billion, an increase of 14%, and net income of $44.3 billion, which was up 13%.

Further than the figures, there were various other very useful pieces of information that can help give us an indication of Microsoft’s future direction:

On-premises

Microsoft stated they had seen “a slow-down in transactional licensing” and that on-premises server revenue was “relatively unchanged”. While both of these will, to some degree, be due to the impact of COVID-19 – they are also what Microsoft ultimately want to see happen. They’d like transactional licensing (Open, MPSA, EA etc.) to be replaced by the new breed of subscription licensing via agreements such as CSP and MCA and for on-premises servers to be superseded by a combination of Microsoft 365 & Azure.

Azure

They are seeing an increase in larger, longer-term Azure contracts with “material growth” in contracts of $10 million and above. Locking customers into longer contracts is a key play for vendors in the subscription world – the more predictable revenue they can bank on, the better. Contracts of a longer nature also present a great opportunity for the customer to negotiate a lower price, as a reward for your commitment.

Office 365

Microsoft have seen an increase in the “Average Revenue Per User” (ARPU) for Office 365 – this means that not only are they selling Office 365 to more users, but they are also earning more money from each user. This is likely due to customers upgrading from E3 to E5 or purchasing some of the security add-ons for example. In somewhat related news, Microsoft also reported that the Microsoft 365 E5 user count has more than doubled, year on year.

All of this shows that Microsoft’s plans are coming to fruition and they are gradually moving their customer base across to the subscription-based cloud. If you’re not on that journey with them, it’s very likely it will become more difficult and more expensive to stay on-premises. With such positive numbers, there’s little chance of Microsoft performing audits/compliance checks just to drive revenue – but is it possible as a mechanism to help move “stubborn” customers toward cloud?

Further reading

SAP

Q2 FY20

SAP’s Q2 saw revenue increase 2% to €6.7 billion, with “cloud revenue” increasing 21% to just over €2 billion. Revenue for “software licenses” was down 18% to €0.77 billion, which was actually an improvement over the €0.45 billion they saw in Q1. Let’s take a look at how some of the product divisions performed:

- Over 500 S/4HANA customers came onboard during the quarter, 37% of which were classed as “net new” to SAP, bringing them to a total of “more than” 14,600 customers. Interestingly, only around half (7,400) of those customers are live.

- Customer Experience “almost doubling” new cloud business in the quarter.

- Over 760,000 new external workers were added to SAP Fieldglass – I’d hazard a guess this is driven by the increased remote working due to COVD-19.

- Concur was down 4% due to the dramatic drop in worldwide business travel.

- Qualtrics revenue increased 34%.

SAP call out Qualtrics on a couple of occasions as a positive performer and, on July 26th, they announced their intention to take Qualtrics public via an IPO (Initial Public Offering) in the USA. SAP will retain majority ownership and have “no intention of spinning off or otherwise divesting its majority ownership interest”.

They also note that they’ve extended open access to SAP Ariba Discovery to the end of 2020, in an effort to “address ongoing disruption to global supply chains”. I wonder what potential that causes for non-compliance in 2021?

Looking ahead to the rest of the financial year, SAP are predicting cloud revenue growth of 18% – 24% and overall revenue to increase between 1% – 3%.

Further Reading

SAP results

Qualtrics announcement

ServiceNow

![]()

Q2 FY20

ServiceNow’s Q2 saw them hit close quarterly subscription revenues of just over $1 billion, a 30% YoY increase that was driven by forty transactions over $1 million, including two over $10 million. Their renewal rate is a very high 97% – indicating that once an organisation becomes a ServiceNow customer, they stick around.

Further results

ServiceNow press release

ServiceNow investor presentation

Related articles:

About Rich Gibbons

A Northerner renowned for his shirts, Rich is a big Hip-Hop head, and loves travel, football in general (specifically MUFC), baseball, Marvel, and reading as many books as possible. Finding ways to combine all of these with ITAM & software licensing is always fun!

Connect with Rich on Twitter or LinkedIn.