Who do you trust?

Editors Note: I’ve known Paul Sheehan for over a decade. He is a forthright, well-respected and experienced SAM practitioner and I’m pleased that I’ve finally convinced him to step out of the shadows to share his experience with the ITAM Review community. In this first article Paul delves into the murky depths of independence and profit motives in the SAM market.

Who do you trust?

I read Martin’s recent article on the SAM Services offered by Partners with interest and concur that many Partners seem to be jumping on the Microsoft Review/Audit bandwagon.

Since this article covers independence and integrity in the SAM business – let me be open and crystal clear from the outset. My company makes a profit from helping medium/large companies manage their IT assets. , and after clear requirements analysis this can include the supply of tools. We don’t audit on behalf of vendors, and we don’t sell volume licenses. We’re very proud of what we do and the value we bring to our customers.

As a provider of license management services in Europe since 2002, we have however seen our fair share of companies abusing their position in the SAM market and taking advantage of customers.

My umbrage is not with partners selling services and making money from SAM, as I believe the community provides a very valuable role – my issue is with companies claiming to be operating independently and acting in the best interests of their clients when clearly they are not.

What does independent mean?

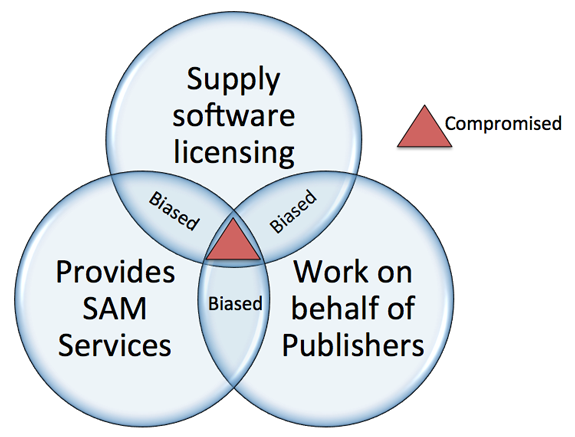

When choosing SAM services you need to be fully aware of three key market dynamics:

- The money made from the supply of volume software licenses – one of the first deliverables of a successful SAM programme is to provide visibility of your effective license position. This may result in a shortfall, surplus or in our experience a mixture of both. There is a conflict of interest if the partner assessing your license position is also supplying the shortfall. This is not an anti-reseller sentiment but just a commercial fact of life. You don’t want the fox running the hen house. In any other governance-led process in business, especially when significant sums of money are at stake, this would not be allowed.

- The relationships partners have with software publishers – the second commercial market dynamic is the relationship SAM partners have with software publishers. When a partner is working closely with a software publisher such as Microsoft, Adobe or Oracle the partner is often contractually obliged to disclose any findings regarding your license position.

- The relationship partners have with tools providers – recommendations made on tools need to be objective, and made in the best interests of the client, not driven simply by the tools the partner happens to sell (unless of course this is part of a full managed service and irrelevant to the client).

Now let us take a look at the key players in the SAM market in relation to those commercial interests:

- Software Licensing Resellers – companies that supply you with software licensing. Licensing resellers, such as Microsoft Large Account Resellers (LARs) usually have a good knowledgebase of licensing expertise and provide help with day-to-day enquiries around licensing.

- SAM Consultants – Companies that provide advice, technology or services to aid organisations with their governance processes and management of software assets.

- SAM Review / Audit Partner – Companies that audit or ‘review’ organisations on behalf of software publishers.

- Tools Vendors or Resellers – organisations that make their money from getting the tool deployed, but who take no responsibility for business outcomes.

As you can see from the image above, overlapping offerings create biased commercial interests. In my experience, a partner offering SAM services, working on behalf of publishers and also supplying licensing whilst claiming to be independent is actually often highly compromised. Where there is bias, there is often far more design in the actions of the partner than most users truly understand – a murky underbelly of this industry often cloaked by slick salesmen.

I particularly highlight pitches such as ‘because we audit on behalf of a vendor, we can protect you if you engage with us directly as a consultant’, ‘we will deliver license optimisation services free if you buy your software from us’ or from tools vendors ‘our tool is best’ before they even understand your problems and existing investments, or have ever actually seen the competition.

It is not only the end user who faces this. My consulting firm is regularly placed under pressure by unscrupulous vendors trying to remove us from advisory engagements because they know we will establish the facts regarding comparative functionality fit.

Declaration of Interests

So how do you navigate these issues and assess the commercial integrity of a SAM partner? The answer is rather straightforward – ask your prospective SAM partner to formally declare their interests.

Direct questions to ask:

- Where do you make your money?

- Do you take a gross profit (direct, commission or otherwise) from volume licensing? Will you sign up to this in a contract?

- Do you have a commercial relationship with software publishers? If so what information is disclosed, on what terms and at what time?

- Has your organisation ever reported a current or previous client’s under-compliance to a volume software vendor?

- What is your relationship with tools vendors, and do you make money from them?

- How much ownership of business outcomes for licensing do you take? How?

- What is your company’s split of net income between tools, vendor audit, services and volume license supply?

My intention is not to steer you to choose between one of these types of partners since they all have their values – it is simply to urge you to be fully informed of their true business motives before engaging with them. Unfortunately we are all too familiar with companies that have been sold on a sales pitch by a so-called independent, only to find out they are actually now locked in with a partner they feel uncomfortable with. Don’t be fooled by salesman’s reassurances; seek the facts.

Related articles:

Second-hand Software: Legalities & Business Models

Joint Research Project with Forrester Research - SAM in 2012

Gartner Magic Quadrant for SAM Managed Service Providers 2021

Free Access to Ten Gartner ITAM Research Papers

Quick guide to Network Licensing and Software Defined Networking

Software vendor incentives are key to ISO/IEC 19770 adoption

- Tags: Channel Integrity · ITAMS · ITAMS Solutions · Partner Integrity · SAM Partners

About Paul Sheehan

Paul is co-founder of IT Asset Management Solutions (ITAMS) and heads up the consulting team and delivery operation. With over 25 years of industry experience, he takes an active role as Managing Consultant and strategic advisor to the company’s medium to large clients.

In recent years he has been instrumental in developing and delivering tailored managed services for licence management in collaboration with enterprise clients.

This article is very true and with my own personal experience, every organizations should be mindful of these unethical practices.

Very good article, I’m in the boat of agnostic. Not only do we not sell software we have no ties to software vendors, resellers or publishers. Some have tried but failed. I pride the work I do on this fact.

Thanks Paul, good article, and exactly what we have seen in the Oracle Market for years.

Great article and entirely correct where bias is concerned. Customers facing audit need independent representation; the auditors are working for the other side.

Very true. It is also good to understand what relationships exist between tool vendors and software publishers. Some seem to be a little too close for comfort

If organizations subject of audits don’t do their homework and solely rely on their suppliers both HW & SW (In most cases the same) will be in for a surprise. Like Scott Braden points out “auditors are working for the other side” take it from somebody that worked for both enforcer and publisher on the sw anti-piracy campaign.

Great article. As a tool and consultancy provider (Aspera) it’s an uphill road when you’re trying to explain to an end-user that the “free” SAM tools he gets from the software reseller might not be as “free” as he thinks. Let alone go down the road of comparing data quality. To a certain extent it’s a matter of how much pain the end-user has.

Perhaps not every one who even claims to be independent, is in fact independent. I can see that paying for advice when there is no sale of software, managed service or anything other than professional advice can be independent, but this is rare these days. Many of the people claiming to have nothing to gain magically end up selling software, tools or services which then leaves a bad taste in the mouth when the project over-runs or drains them of all their money. If this is what is intended, be up front and tell the customer, but pretending that advice is given without this actually being a lead into a (much larger and more profitable) sale of tools etc is not trustworthy, and eventually the truth will come out. Customers are often not mature enough to spot the difference between the good and bad products/services, however tools vendors with good knowledge are often more trustworthy despite having a possible sale in mind. I wonder if the tool being recommended by independent advisers have more to do with the profit margin being made on the current ‘deal of the day’ rather than a fully open appraisal of the tools stengths/weakness for the cost. I am sure that customers are persuaded to buy tools which maybe might not be the best for them but which make the adviser the most margin, rather than the customer deciding for themselves. Not all is not as it seems in this market.

Thanks to Paul and Martin for the opening the thoughtful discussion about SAM Partners and about selecting the right SAM Partner. The need for having a trusted and independent SAM partner is critical.

We need to remember that *every* commercial entity has their own best interests at heart; and so any notion of true “independence” is a falsehood. Auditors work for the vendors and thus have a vendor-biased perspective. “Independent” SAM partners work for the customer and therefore have an opposite, customer-biased perspective. Most SAM partnerships are formed in the grey area in between. So the key to picking the best SAM partner – as Paul points out – is a full understanding of the partner’s interests (some of which they will disclose and some that they won’t).

Where my opinions diverges a bit from Paul and some of the other respondents is in the generalization that partners that sell products (VARs/LARs) are inherently less independent or less trustworthy as SAM providers. In fact, there are very few roles and partnerships in the IT industry where the rules of engagement are as public and time-tested as those in customer/LAR/vendor relationships. In those partnerships, the parties have been balancing the potential conflicts of interest for decades … and have learned to turn those “conflicts” to advantage in building long-term, advantageous partnerships.

A world-class LAR with a world-class SAM process could be one of the best SAM Partners a customer can have. The relationship brings openness, extensive product/license experience, and in-depth knowledge of customer needs – all within the context of broad and long-term relationship. These are key ingredients to a successful SAM partnership.

My intent is not to say that ALL resellers would be good SAM partners. But I think it’s important to point out that some of the challenges in the reseller/customer relationship can be strengths that contribute to a stronger and more complete SAM process for the customer.

Full disclosure: It probably won’t surprise anyone that I have this opinion. I am, after all, privileged to lead the ITAM Services Practice within SHI International (a $4+B LAR/Service Provider). But it is important to point out that for me this is not just some “line” any reseller would say. SHI’s SAM Mission springs from our belief that a true, full life-cycle SAM program can best be enabled with a partner who has an enduring relationship with the customer, is committed to the customer across a wide portfolio of products, and provides value throughout the entire software life-cycle.

Partly in response to this issue and because not all VARs/LARs are created equal, I recently posted a blog article that specifically cites SHI advantages. (http://blog.shi.com/2013/01/09/6-reasons-why-shi-should-be-your-itam-partner/)

Erik’s comments are very well made, and I have to say one of the first professional, balanced responses to this age old challenge I have seen from a volume software supplier since I posted…

Times are changing for the channel community, and perhaps the mid tier SIs (UK perspective) are in a good place here… they have a head start on the pure LAR play, with an ‘already developed’ service culture. The jump is therefore not as dramatic for them. The cynic in me also says there are bigger fish to fry for them in each account, so tactical licensing revenue is less likely to drive their core thinking.