76% admit to over-licensing in fear of audits

This article provides the results of our survey into the ITAM business case from November 2015. Thanks to our friends at Cireson for sponsoring this research.

Introduction – The business case for ITAM

The goal of this project was to identify how organizations measure the business case for ITAM, how do they quantify the business value of ITAM? Thanks to the 114 organizations from 23 different countries who provided their feedback.

Key topics covered:

- HAM maturity

- SAM maturity

- Business Drivers – why are they investing in ITAM?

- Attitudes to over-licensing, over-spending and likely compliance position

- Key performance indicators and other measurements of success

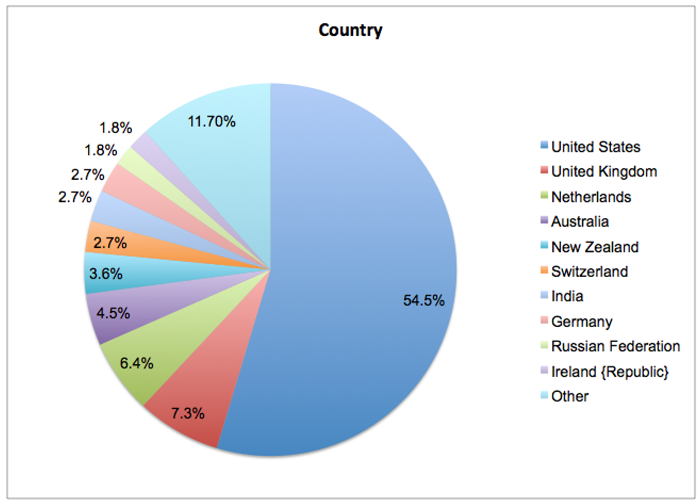

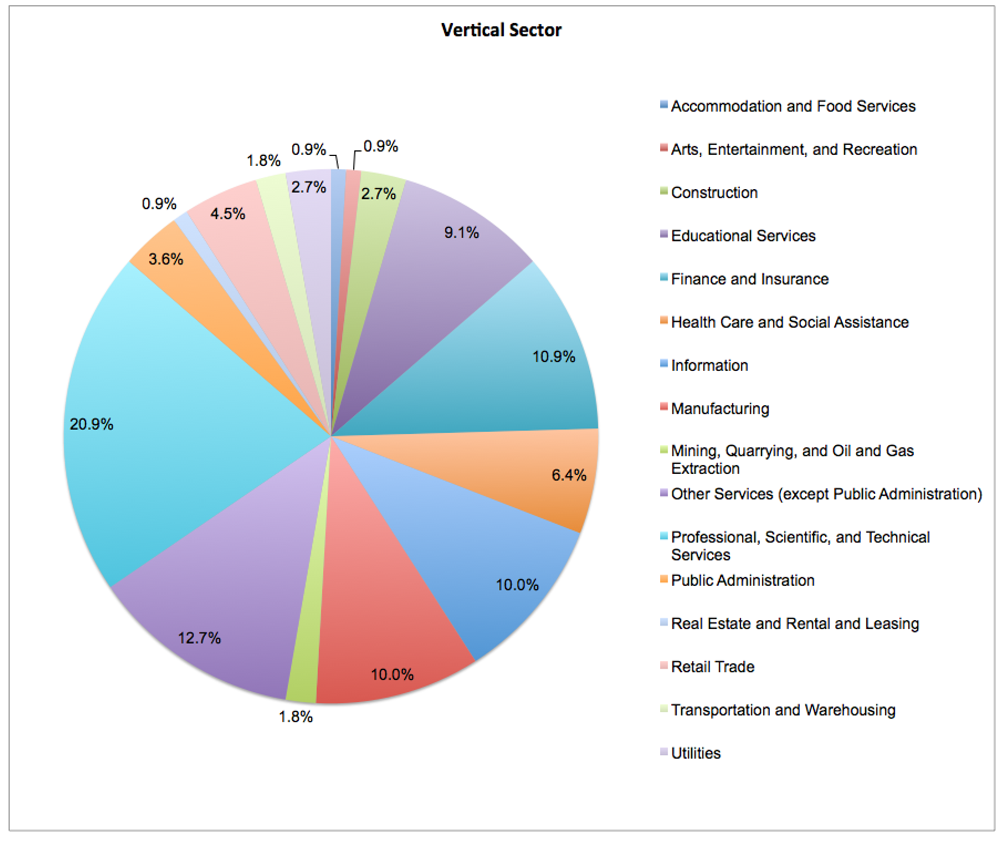

Of the 23 countries responding, over 50% of respondents were from USA, followed by UK, The Netherlands and Australia. A wide range of vertical sectors were represented (see figure 1 and 2 below).

Countries Participating

Vertical Sector

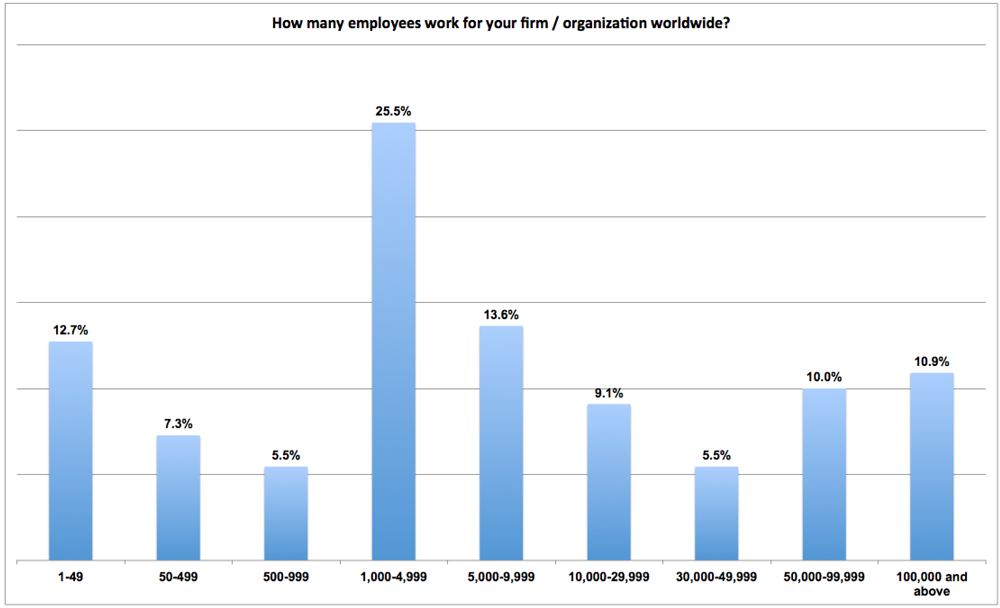

A variety of different size organizations participated in this study, from very small organizations to very large corporations. The largest feedback was received from the core 1,000 – 4,999 mid-market segment that represented 25% of respondents. See figure 3 below.

Cireson has sponsored this project.

Cireson has sponsored this project.

The contact details for survey participants were NOT shared with Cireson – they have just kindly underwritten our research project.

Thanks to the team at Cireson for their support.

Measuring ITAM maturity

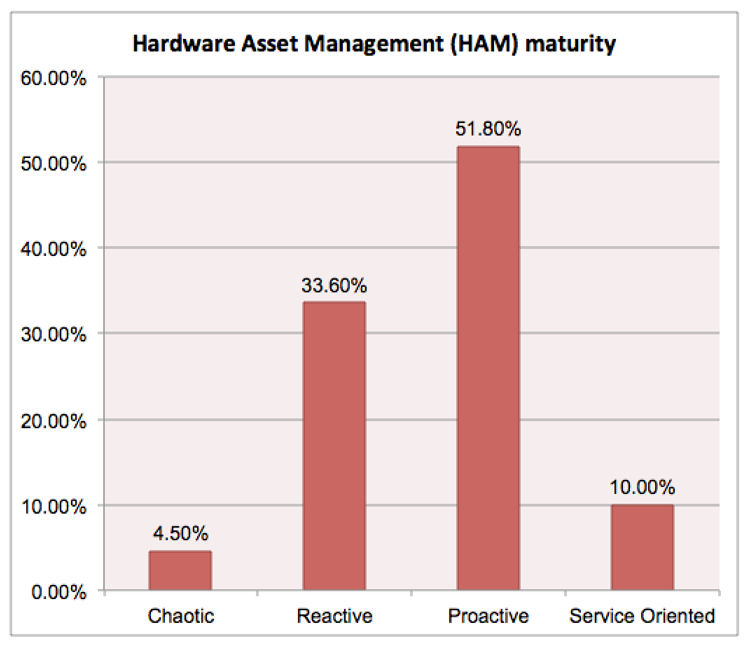

Organizations were asked to self-assess both their Hardware Asset Management (HAM) and Software Asset Management (SAM) maturity using the following ratings:

- Chaotic. No defined processes, personnel, or tools.

- Process is focused on asset counting. No dedicated personnel. Tools provide physical inventory capabilities and stored on spreadsheets.

- Proactive. Process is focused on asset life cycle. Dedicated personnel to process and tools. Tool provides automated inventory collection and aligns.

- Service Oriented. Process and tools expanded to align with IT Service Management and Financial processes. Dedicated personnel to processes and tools.

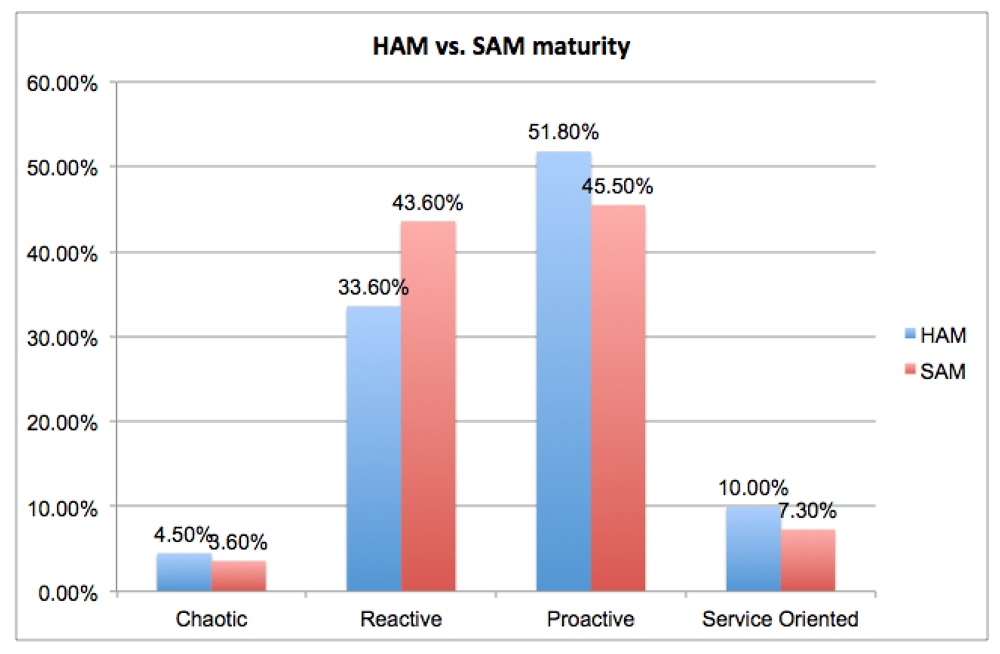

From a HAM perspective it was refreshing to see 51.80% of respondents self-assessing their organizations in the ‘Proactive’ category. The least mature response of ‘Chaotic’ was only selected by 4.5% of organizations. See figure 4 below.

Figure 4 – HAM Maturity

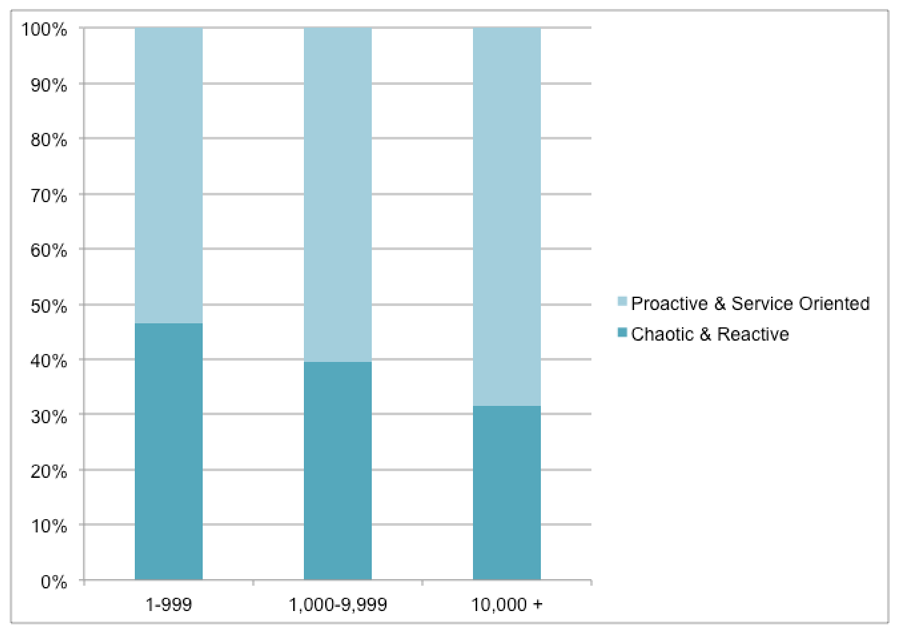

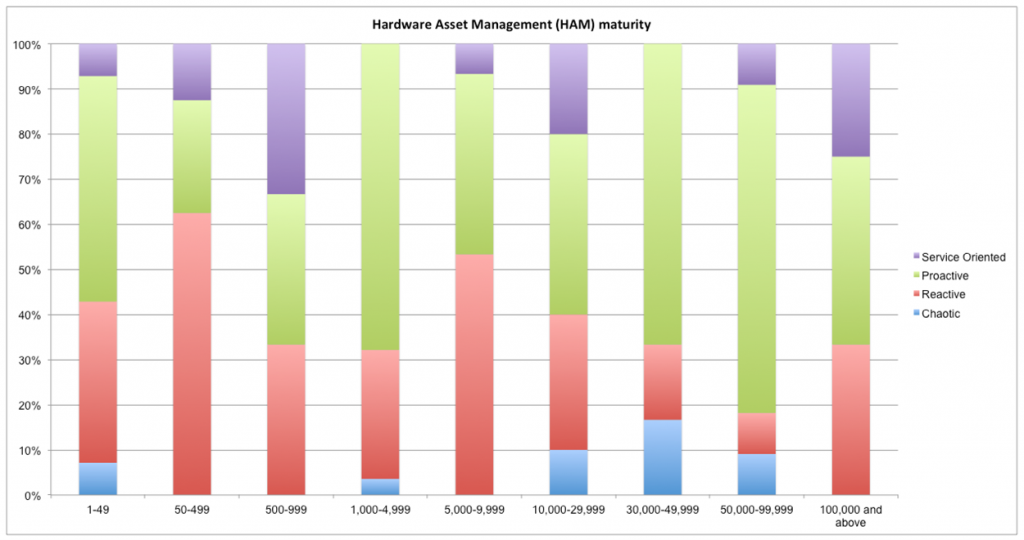

A trend in HAM maturity by organization size is not obvious (see figure 5 above). However by aggregating data into three larger size groups and only two maturity types a more obvious trend can be seen: whereby larger organizations are demonstrating slightly greater maturity (See figure 6 below).

HAM by size aggregated

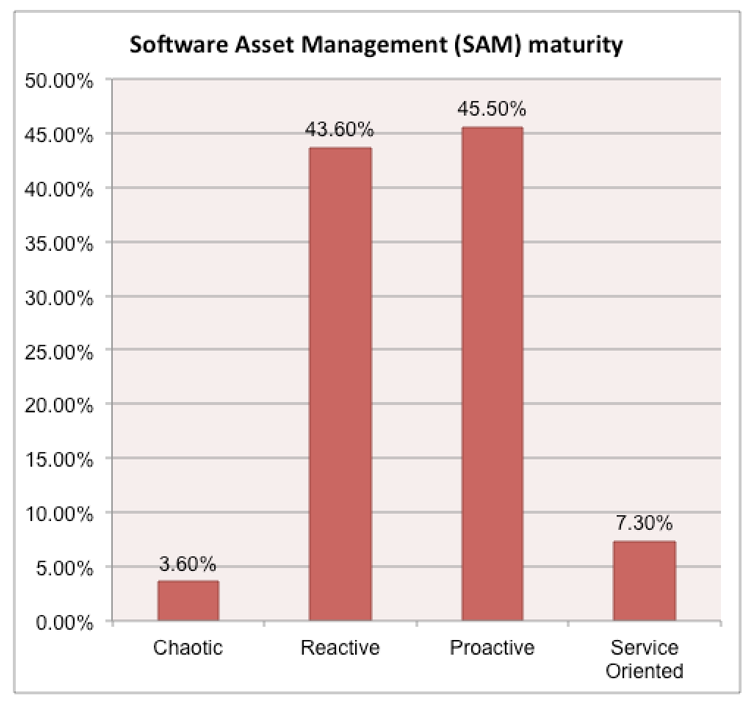

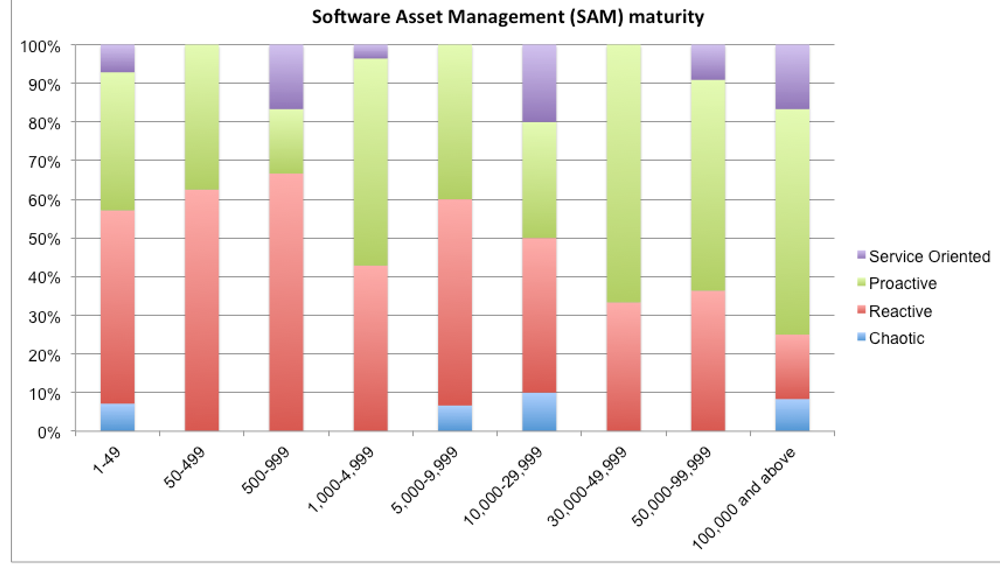

SAM maturity demonstrates a similar level of progress, with a significant 45.50% self-assessing as being in the ‘Proactive’ in their maturity (See figure 7 below).

SAM Maturity

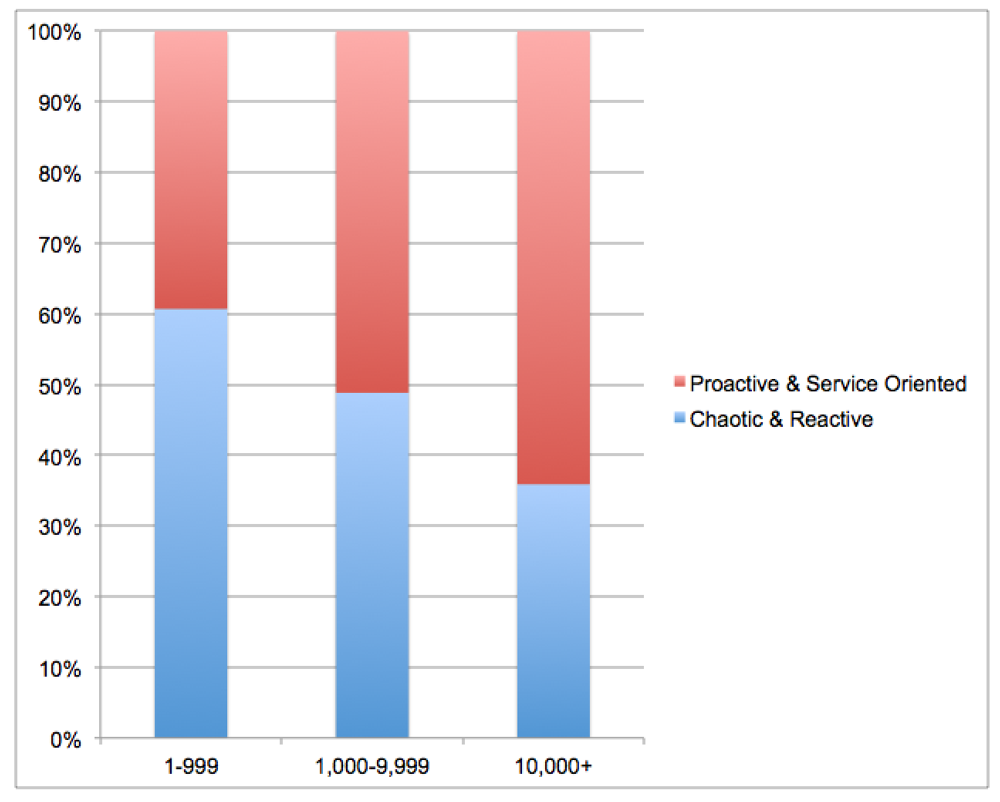

As with HAM, a trend in maturity can be seen in larger organizations (See figure 8 & 9 below).

SAM by size aggregated

By comparing HAM and SAM maturity side by side you could argue that HAM is slightly more mature than SAM. This is a natural progression step since organizations are likely to start (and will need to address) HAM before starting SAM (See figure 10 below).

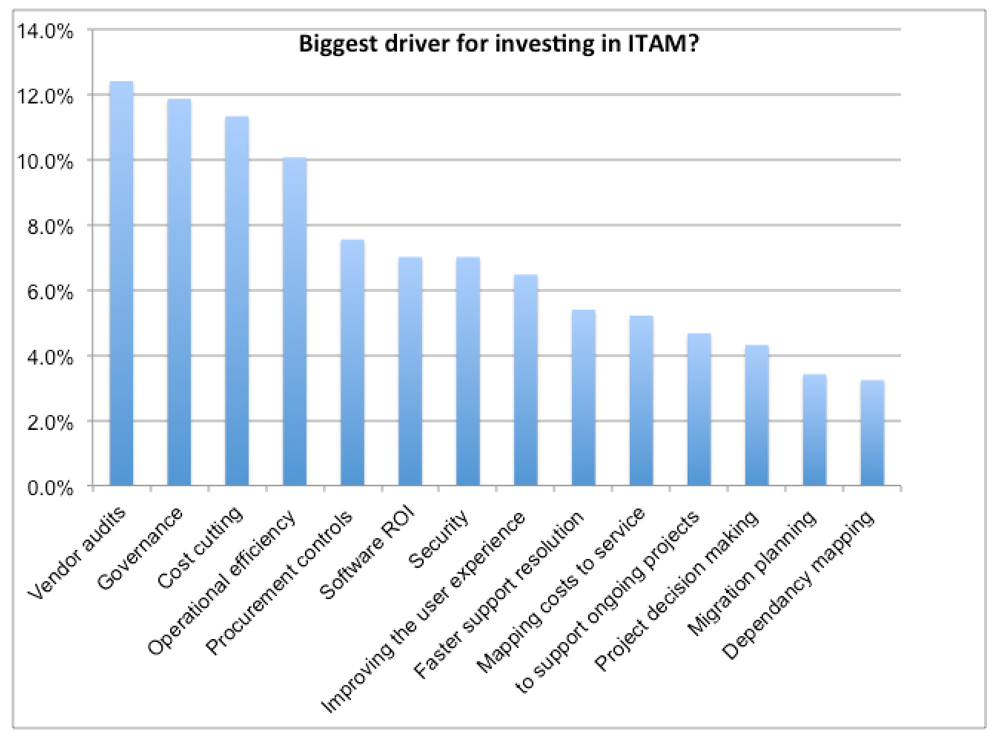

Business Drivers for Investing in ITAM

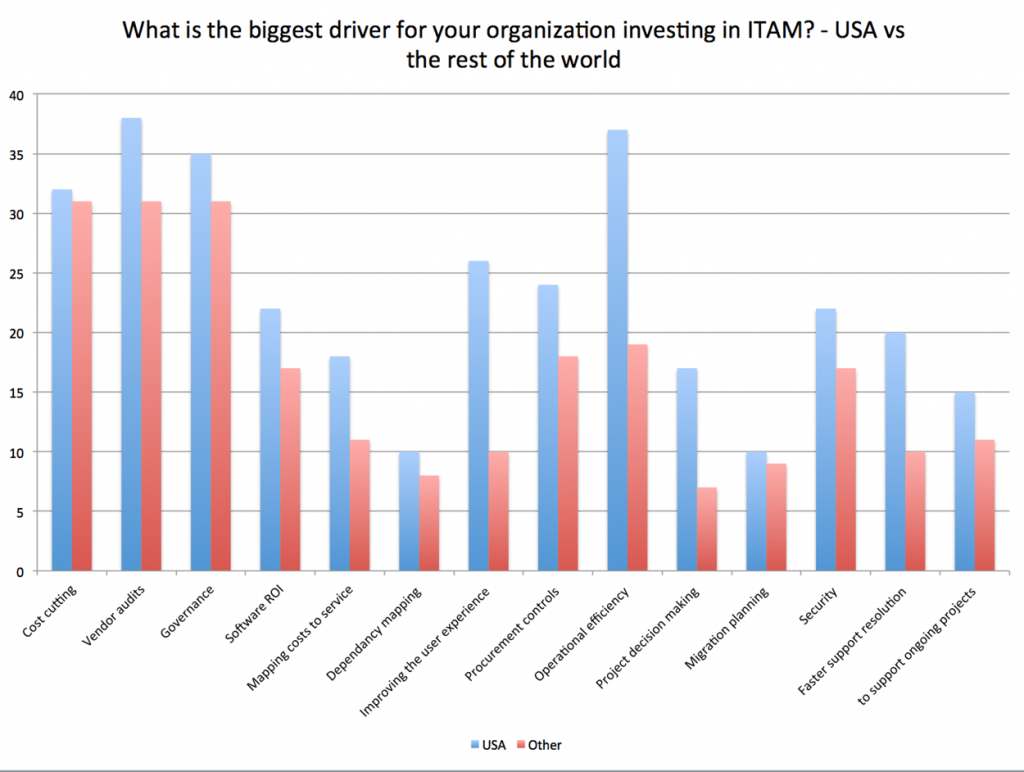

Survey participants were asked to identify the key business drivers for their organization investing in ITAM. Whilst there was no single dominant response, vendor audits, governance and cost cutting came out on top (See figure 11 below).

Business drivers were analyzed between respondents from the USA and all other countries. Improving the user experience and operational efficiency was shown to be much more important compared to other countries and proven as statistically significant (See figure 12 below).

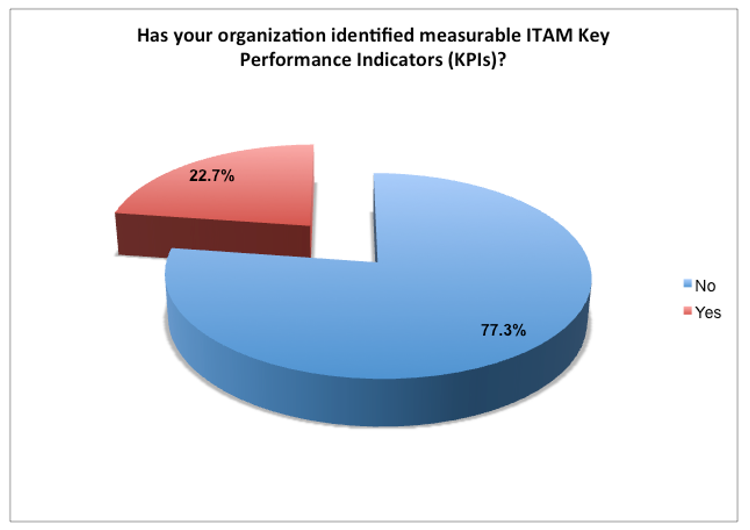

Rather alarmingly, less than 23% of respondents were able to identify key performance indicators that demonstrated the impact of their ITAM practice (see figure 13 below).

Figure 13 – Key Performance Indicators

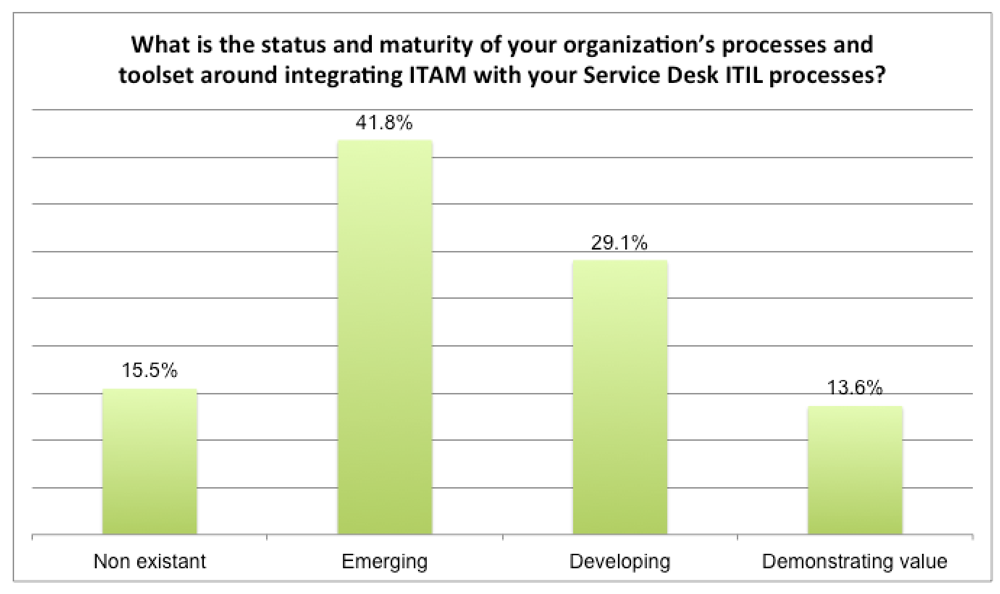

Integrating ITAM and ITSM processes and toolsets is a growing area of interest with over 70% reporting either emerging or developing interest in integrating ITAM with Service Desk processes. This is a key step when organizations are seeking to be more agile and responsive with their ITAM data (see Figure 14 below).

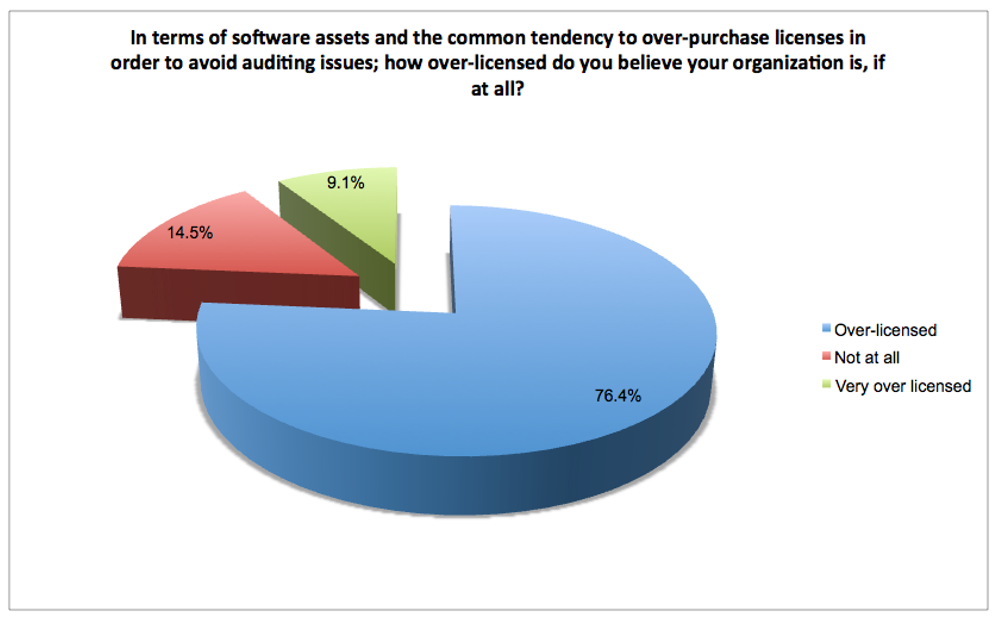

Over compensating for audits with over licensing

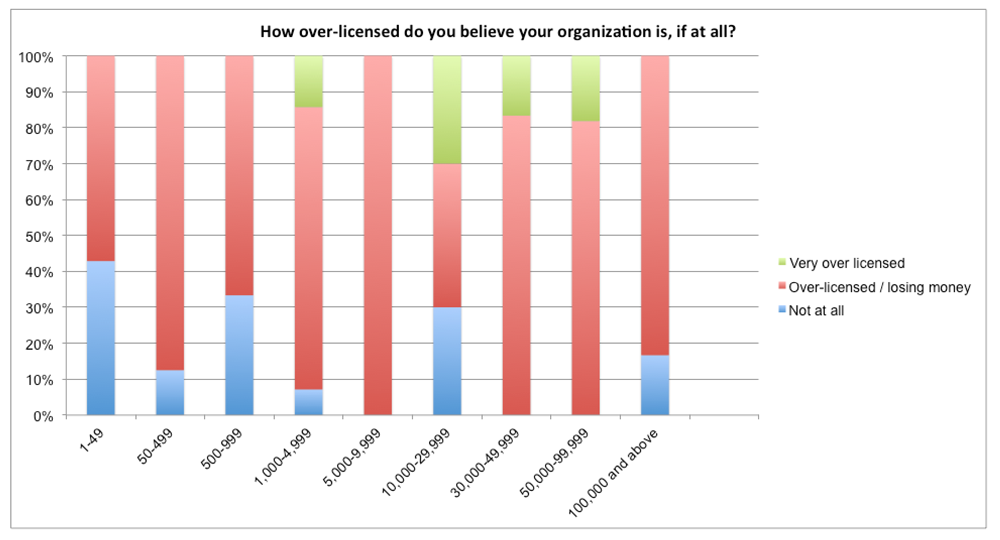

Participants were asked regarding their estimates of their compliance position in response to audits, were they likely to be compliant, over-licensed or very over-licensed. 76.4% admitted to being over-licensed whilst 9.1% admitted to being very over-licensed. Organizations larger than 10,000 showed a greater likelihood of being very over-licensed (See figure 15 & 16 below).

Summary

Thanks again to Cireson for supporting us on this project.

It is clear that software audits continue to dominate the industry and organizations are over-compensating by over-licensing their estates. It is pleasing to see an increasingly mature ITAM industry reaching out of the chaotic phases of growth and realizing the business benefits of ITAM. It would be good to see further focus on the development and usage of key metrics so that ITAM professionals can more readily measure their progress and impact.

Do you have any comments or insights to add based on our analysis? Please leave a comment below.

Related articles:

- Tags: Business Case · Cireson · ITAM · Over-licensing

About Martin Thompson

Martin is also the founder of ITAM Forum, a not-for-profit trade body for the ITAM industry created to raise the profile of the profession and bring an organisational certification to market. On a voluntary basis Martin is a contributor to ISO WG21 which develops the ITAM International Standard ISO/IEC 19770.

He is also the author of the book "Practical ITAM - The essential guide for IT Asset Managers", a book that describes how to get started and make a difference in the field of IT Asset Management. In addition, Martin developed the PITAM training course and certification.

Prior to founding the ITAM Review in 2008 Martin worked for Centennial Software (Ivanti), Silicon Graphics, CA Technologies and Computer 2000 (Tech Data).

When not working, Martin likes to Ski, Hike, Motorbike and spend time with his young family.

Connect with Martin on LinkedIn.

Interesting survey! Maybe is because the overcompensating costs are cheaper than the cost of audit fine.

[…] Strict licensing guidelines. Over a quarter of businesses (76%) admit opting for over-licensing in fear of software audits, the ITAM Review research […]