Enterprise SAM tool market share analysis

I’m midway through a competitive comparison of the top ten SAM tools for large enterprises. See the original call for participants here.

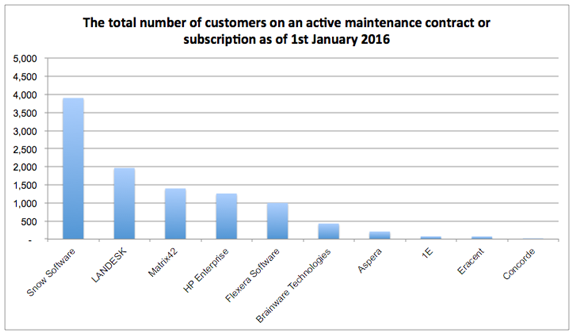

As part of the analysis we’ve collected customer numbers and it is interesting to see the market share of the key players.

SAM tool market share analysis for large enterprises

The charts below are based on two questions:

- What is the total number of customers on an active maintenance contract or subscription as of 1st January 2016? E.g. “As of 1st January 2016, we have 100 customers on a current maintenance contract” and

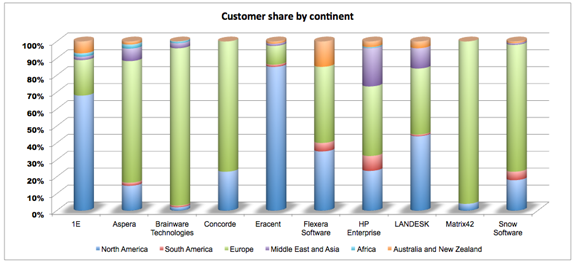

- What is the percentage of customers in each major territory?

Note: All figures are from the suppliers themselves. Some were estimates. Full details will be shared in our upcoming report.

The first chart shows Snow Software, LANDESK and Matrix42 striding ahead in terms of market share, however, note that whilst our report is focused on tools for large customers, Snow, LANDESK, and Matrix42 have many mid-market customers. I.e. the Chart represents ALL SAM customers not just the enterprise customers.

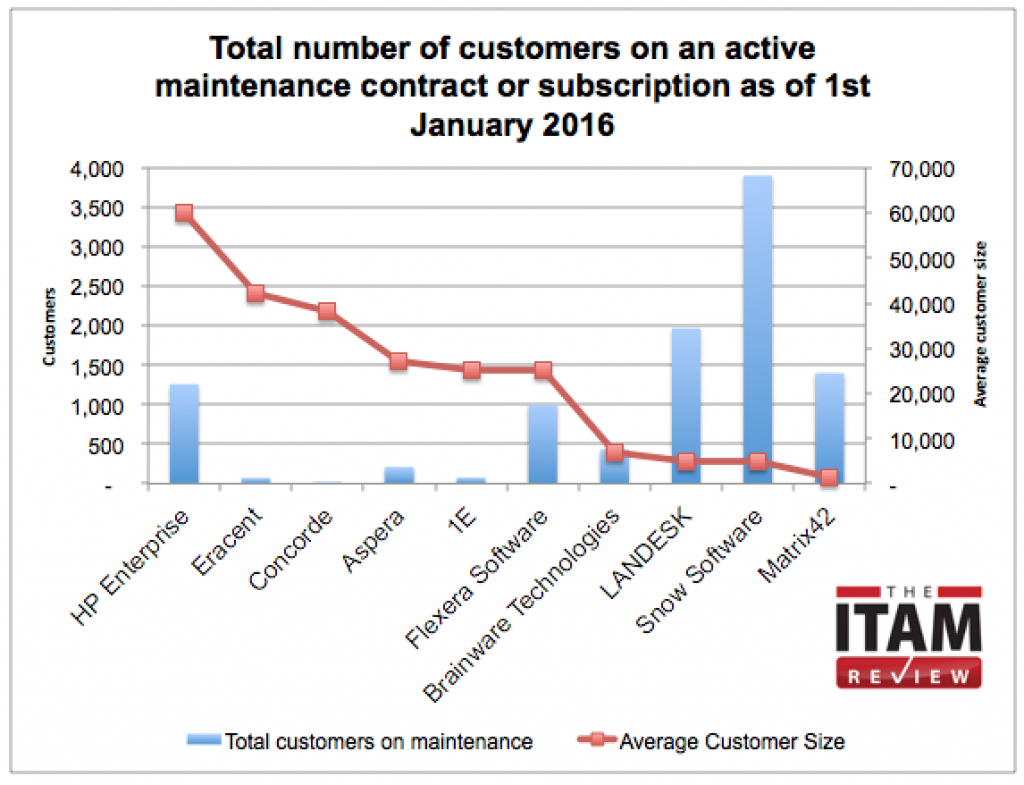

If we add average customer size into the mix we see HPE, Eracent, Concorde, Aspera and 1E with a track record of selling to very large enterprises.

Average customer size, SAM tool market share

The final chart displays customers by continent. Flexera, LANDESK and HPE probably have the most diverse mix of customers by continent, Brainware and Matrix42 with heavy European focus and 1E and Eracent with heavy North American focus.

In purely customer number terms, you might say there was no one dominant global player just yet. Both Matrix42 and Snow Software are placing key focus on development of the US market, so in competitive sporting terms you might say there is ‘all to play for’.

Stay tuned to the ITAM Review newsletter to be notified when our research is published.

Related articles:

Jaguar Land Rover save £30m optimising SAP

ITAM Review Radio Show February 2019 - Axel out, ServiceNow's Madrid, ITAM market size, Cake

Who do you trust?

Weak growth in SAM tools market - are SAM Managed Services to blame?

End User Review [2] - We spend too much on Software

Top Ten Licensing Types – Where is the market going?

About Martin Thompson

Martin is also the founder of ITAM Forum, a not-for-profit trade body for the ITAM industry created to raise the profile of the profession and bring an organisational certification to market. On a voluntary basis Martin is a contributor to ISO WG21 which develops the ITAM International Standard ISO/IEC 19770.

He is also the author of the book "Practical ITAM - The essential guide for IT Asset Managers", a book that describes how to get started and make a difference in the field of IT Asset Management. In addition, Martin developed the PITAM training course and certification.

Prior to founding the ITAM Review in 2008 Martin worked for Centennial Software (Ivanti), Silicon Graphics, CA Technologies and Computer 2000 (Tech Data).

When not working, Martin likes to Ski, Hike, Motorbike and spend time with his young family.

Connect with Martin on LinkedIn.

Q. I can’t see the numbers. A. This is a preview, all figures will be shared in the actual report.

Q. Where did the numbers come from. A. By asking senior contacts within the vendors directly.

Martin

Are you able to include total number of seats/devices managed per tool vendor? That would be a useful statistic and help make sense of the charts above – for example it looks like Concorde have few customers but those customers are large. Snow, Matrix 42 and LANdesk meanwhile have many customers but those are generally small.

Yes Ian these will be published in the full report.

I would change the line diagram in the total number of customers for a bar diagram. There is no relationship between the categories (vendors).

What would be considered “better” more smaller simple installations or complex installations with large (400,000+ devices)?

This “report” makes snow look like a dominant player, when in actual fact, the numbers were no doubt provided by vendors themselves and their is no consideration given to the complexity to which these tools can/can’t provide an outcome to the end customer.

Is a short term ELP considered an “active” customer?

Hi Martin,

Flexera say they have 80k+ customers on their website. Where does the 1000 come from?

Cheers

79,000 of those are for their Installshield / packaging business.

[…] ITAM Review […]